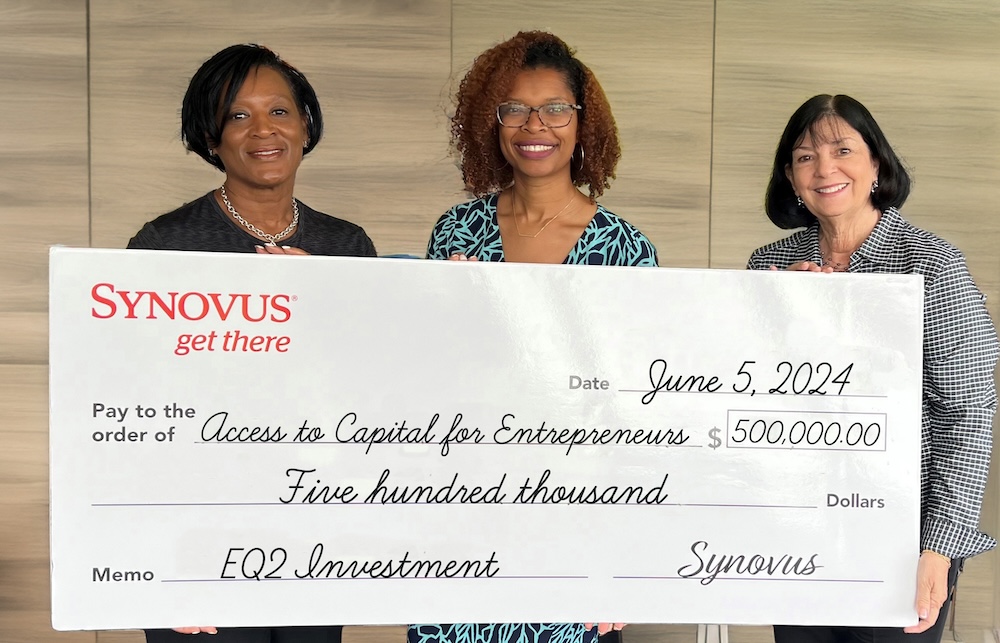

Access to Capital for Entrepreneurs receives $500,000 investment from Synovus

Funds will support capital and credit access for historically underrepresented small businesses throughout Georgia via the ACE Recovery and Resilience Program

ATLANTA, July 01, 2024 – ACE | Access to Capital for Entrepreneurs has received a $500,000 investment from Synovus for its Recovery and Resilience Program. The program supports ACE’s continued efforts to provide diverse and flexible capital solutions and educational resources to Black, Indigenous, and people of color (BIPOC) women and low-income-owned businesses in Georgia.

“Affordable capital fuels successful business growth,” said Martina Edwards, chief of strategic partnerships at ACE. “This support from Synovus allows ACE to continue deepening our work to break down systemic barriers to capital and credit access for Georgia business owners of color to expand their businesses, build assets and create jobs that support communities and families.”

The $500,000 Equity Equivalent (EQ2) investment from Synovus allows nonprofit community development financial institutions like ACE to raise capital with features that behave like an equity investment, improving the organization’s economic strength.

“Synovus is committed to strengthening the communities where we operate and our team members live” said Allen Barker, North Georgia division CEO of Synovus. “Our partnership with ACE ensures diverse, small business owners in Georgia have access to affordable capital to grow their businesses.”

About ACE | Access to Capital for Entrepreneurs Inc.

ACE is a 501(c)(3) nonprofit and community development financial institution (CDFI) that provides loans and business development resources to help its borrowers create and grow sustainable businesses. ACE is an SBA Microloan Intermediary and a USDA Intermediary Relender and the resource of choice for those who are typically not financed fully by traditional lenders. With a mission and focus on underserved people and places, ACE connects small businesses owned by women, people of color and low to moderate income entrepreneurs in metro Atlanta and North Georgia with capital and coaching to sustain their businesses, retain their employees, and thereby support their local communities. Since 2000, ACE has loaned more than $200 million to over 2,600 entrepreneurs, who have created or saved more than 21,000 jobs in Georgia. ACE is supported by grants and other forms of funding from banks, foundations, government entities and corporations to assist in its mission to help underserved business owners. For more information, visit https://aceloans.org/

About Synovus Bank

Synovus Bank, a Georgia-chartered, FDIC-insured bank, provides commercial and consumer banking in addition to a full suite of specialized products and services including private banking, treasury management, wealth management, mortgage services, premium finance, asset-based lending, structured lending, capital markets and international banking. Synovus has branches in Georgia, Alabama, South Carolina, Florida and Tennessee. Synovus is a Great Place to Work-Certified Company. Learn more about Synovus at synovus.com.