Learn

Capital gains for the 2021 season could be huge

When an investor sells a stock for more than the purchase price, the investor experiences a capital gain (it is simpler to call it a profit, but let’s stick to some technical terms for a minute). For example, if you bought Amazon at $2,000 back in July of 2019 and sold it for $3,500 at the end of November of 2021, the capital gain would be $1,500.

Mutual funds operate in much the same way, although it gets a little more complicated. When a mutual fund sells a stock for a profit, it too receives a capital gain and is required by law to pay most of the gain to its shareholders in the form of distributions – after deducting the fund’s operating expenses.

Short- and long-term cap gains

There are two types of mutual fund capital gains – short-term and long-term.

If the mutual fund – not the mutual fund investor, the mutual fund itself – has held the stock for more than one year, then the profit from the sale is treated as long-term capital gain, which is subject to a maximum of 20% tax rate for mutual fund shareholders. On the other hand, if the mutual fund has held the stock for less than one year, then the profit from the sale is treated as short-term capital gains and is then taxed at the fund investor’s ordinary income tax rate.

Estimates are out

Mutual fund firms usually begin estimating and publishing their capital gain distributions in the fall and then make final distributions before the end of the year. You should know that mutual funds don’t all make distributions on the same day—they just need to do so before Dec. 31. And to help you keep track of the distributions and whether they are short- or long-term, mutual funds report this information to shareholders on IRS Form 1099-Div after the end of every year.

Given all this, investors should be aware of purchasing mutual fund shares right before the mutual fund makes a distribution, a term called “buying the dividend.” Generally speaking, investors planning a large lump-sum investment in a mutual fund through their taxable account should avoid buying-the-dividend.

Finally, it is also important to note that there are four types of mutual fund distributions that have tax implications for investors: capital gains, ordinary income (ordinary dividends), qualified dividends and non-dividend distributions, which is often called return of capital. As such, it’s important to discuss the implications of mutual fund investing and taxes with your financial advisor.

What will 2021 bring?

By most estimates, investors will likely see a record year for taxable distributions tied to capital gains in 2021. While we won’t of course know how much will be distributed this year, there are estimates. Here are some interesting stats and predictions from CapGainsValet. But first, some table-setting.

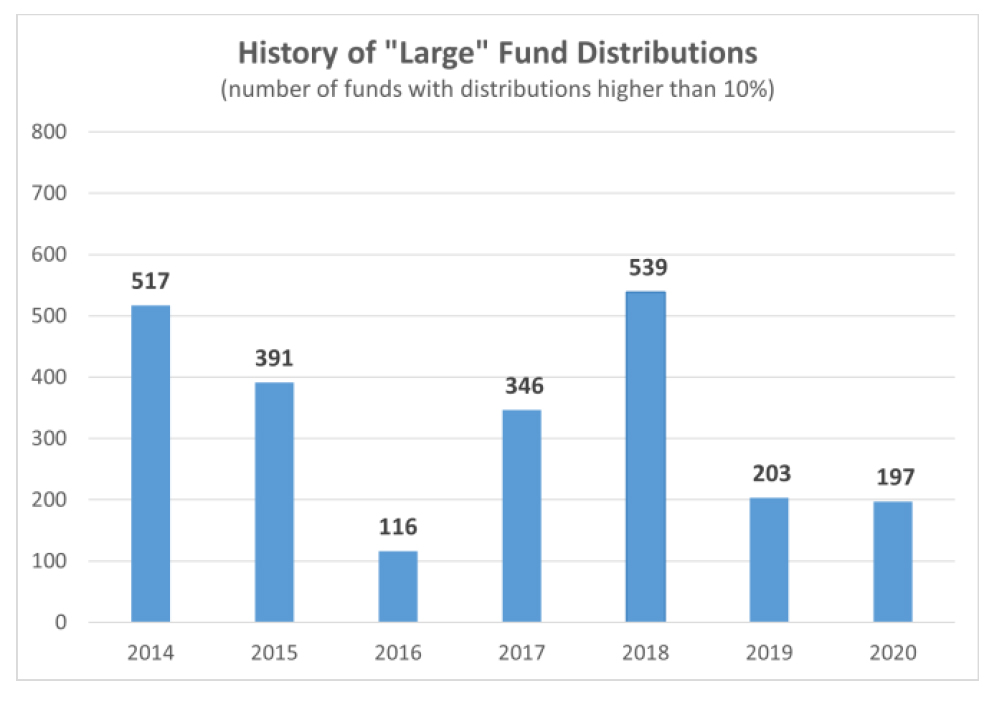

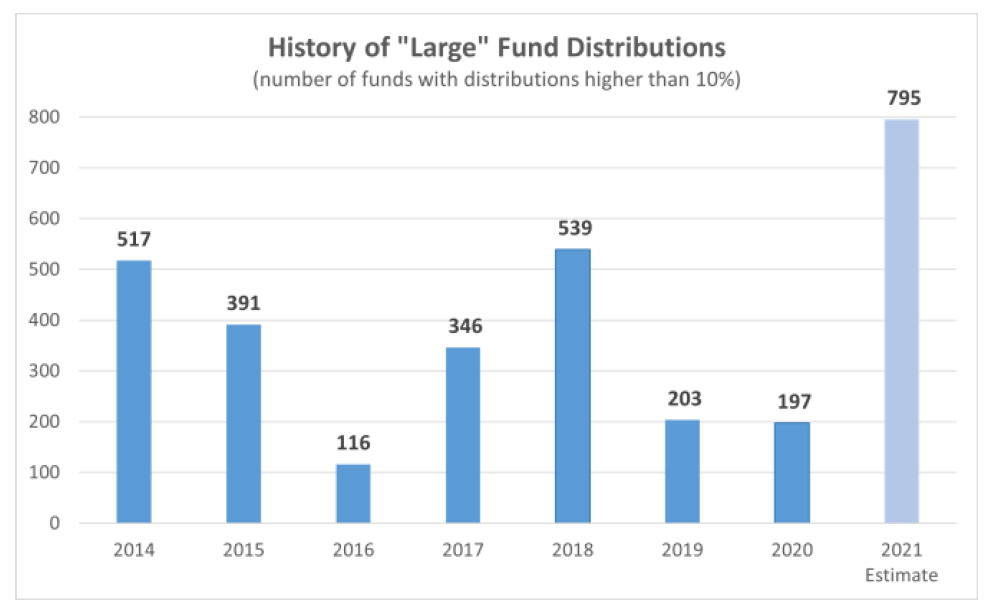

In 2020, investors saw quite a few funds making large distributions (defined as more than 10%). Not as much as in 2018, but still quite a few.

In an average year, investors saw 330 funds with distributions higher than 10% of NAV. But in 2020, with very good market performance and continued mutual fund outflows, 2021 is expected to be much more significant.

And CapGainsValet predicts 2021 will see more than double the historical average of funds making distributions of more than 10%. That’s 50% more funds predicted to make large taxable distributions of more than 10% this year versus the next highest year (2018).

Further, as of Dec. 1, of the firms that have provided estimates of distributions, we see that:

- 604 funds are estimating distributions of over 10%;

- 123 funds are estimating distributions of over 20%; and

- 25 funds are estimating distributions of over 30%.

What should you do?

There are a lot of things you can do to position your portfolio properly amidst what could be a record year for capital gain distributions.

First thing is to simply be aware of the estimates provided by mutual fund companies. Then you might consider certain strategies, including what is called “harvesting losses.”

Your Synovus financial advisor can help you determine what your impact might be this year, and help design a course of action that is consistent with your overall financial plan.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.

People are also reading

Do you have questions or ideas?

Share your thoughts about this article or suggest a topic for a new one