December Market Update: A Santa Claus rally for stocks or just a lump of further losses?

The holiday season is upon us. It can be a time for family, reflection, and positive seasonal market returns for stocks. The S&P 500 is up over 12% from mid-October and up over 8% since the mid-term elections. Historically, the fourth quarter has provided higher returns for the S&P 500 accounting for nearly 80% of the time when measured against all quarterly returns, averaging 3.9% since 1950, also known as the “Santa Claus Rally.”

Chart 1

2022 has brought one of the most challenging market conditions for both stocks and bonds in over 30 years. Inflation has been the catalyst for the Federal Reserve’s wrecking ball of rising interest rates. The sharp movement for interest rates this year has created mass volatility throughout the markets but, knowing where to navigate in the cross winds of risk may provide the difference of a manageable voyage or choppy seas ahead. Let’s start by defining the current headwinds of the markets.

Inflation (Consumer Price Index)

Inflation is still the number one headwind for the markets at this time since it accounts for the direct increase for prices paid for housing, wages, energy, and food. As of October 2022, the U.S. inflation rate stands at 7.7%. Though lower than the expected 8% forecast, inflation is still more than three times higher than the target that the Federal Reserve is trying to achieve even when measuring by their defined metric, the Price Consumption Expenditures (PCE Index) currently at 6.o%, as of Dec. 1.

The Fed

The Federal Reserve is still on track to continue their quantitative tightening, or QT, policy throughout 2022 and into 2023. At this time, the bond market as priced in two additional rate hikes of .50% for over the next two FOMC meetings (Dec. 15 and Feb. 2) bringing the Fed Rate to 4.75% to 5% and an additional .25% rate hike in March 2023. The challenge will be reducing inflation and creating enough consumer demand reduction to lower prices even further into 2023 without pushing the U.S. economy into a recession. The JP Morgan 4th Quarter Guide to the Markets chart maps out the forecasted Fed Funds rate for 2023 through 2025.

Chart 2

.jpg)

Corporate Earnings

According to the FactSet Earnings Insight report, 94% of the S&P 500 companies reporting Q3 earnings results, 69% of S&P companies have reported positive earnings per share (EPS) and 71% of S&P companies have reported a positive revenue surprise.1 Earnings growth for Q3 was 2.2% and if this growth rate sticks with the rest of the total S&P firms reporting, this will mark the lowest earnings growth in 2 years. For earnings guidance in Q4 2022, or the forecast for future earnings performance, 55 S&P companies have issued negative EPS guidance and 27 S&P companies have issued positive EPS guidance, which provides a bit of a mixed bag of projected performance going into the end of the year.

The challenge will be reducing inflation and creating enough consumer demand reduction to lower prices even further into 2023 without pushing the U.S. economy into a recession.

The challenge will be reducing inflation and creating enough consumer demand reduction to lower prices even further into 2023 without pushing the U.S. economy into a recession.

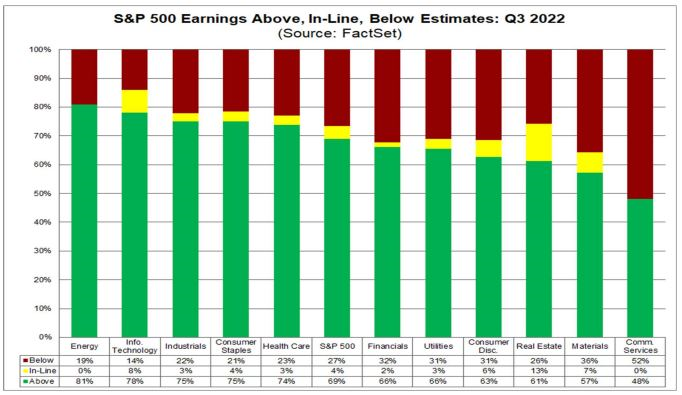

Despite the quarter over quarter decrease in the number of S&P companies citing the term “recession” on their earnings calls, companies have been more pessimistic than normal on their Q4 2022 performance outlook with analyst expectations of a decline in earnings of -2.1% for Q4 2022 but earnings growth of 5.2% for current year (CY) 2022. Looking forward to Q1 2023 and Q2 2023, analysts are projecting earnings growth of 1.6% (Q1 2023) and 0.9% (Q2 2023) and earnings growth of 5.7% for CY 2023. You can see, in Chart 3, the percentage of companies in each sector of the S&P 500 above, in-line, or below their earnings estimates.

Chart 3

Markets finishing 2022 on Santa’s Nice list?

With the current headwinds described above, there is potential holiday cheer that can spread throughout the markets into year end. Although inflation is still above the current Fed target, the rate of inflation is declining, which provides hopes for the markets in a reduction of the Feds QT policy may be coming to an end within the next few months. Most of the shock and awe of the markets have been dealt with and it is possible that the worst of the market volatility is behind us.

The Federal Reserve has increased interest rates by .75% for the past four rate hikes and now we may be looking at the first projected .50% rate hike since May 2022. This can also provide signs to the markets on opportunities for heavily discounted sectors of the market such as the semiconductor sector. Also, Q3 earnings season EPS and growth were better than expected and though Q4 earnings estimates may be projected lower, the U.S. consumer still remains strong in the face of declining inflation.

The last point is biggest difference in the markets now for new and current stock investors is “TINA” vs “TARA”. When interest rates where close to 0% during the Fed’s previous Zero Interest Rate Policy (ZIRP), there was an acronym that stipulated, “There is No Alternative” (TINA). It’s either stocks or dividend paying stocks or earn nothing in cash and/or bonds. Now, the risk-free rate of return on CDs and T-bills within 12 months are paying over 4.5%. TINA has changed to TARA or “There Are Reasonable Alternatives.” Stocks now have to compete with 4%+ risk free U.S. T-Bills or FDIC insured CDs. This may provide some hesitation for wealthy investors with large cash positions, who are near or in retirement, to reassess their options and allocation percentages into the stock market.

I remain cautiously optimistic for stocks going into 2023. Santa may still come down the chimney bearing gifts but, we may just end up with socks or slippers instead of the big gift of a rally that we have been waiting for.

Christopher Brown, CIMA®, CRPC™, Financial Advisor, Synovus Securities, Inc.