Millennial Money: Your first Bear Market…what’s next?

A Bear Market occurs when the broad market index (Dow Jones, S&P, NASDAQ) declines by more than 20% from its recent high. 2022 has been one of the most challenging market environments since the GFC (Great Financial Crisis) of 2008. For most investors under 40 years old, this is your first bear market experience. Welcome to the 2022 markets, please fasten your seat belts and return your tray in their upright positions.

The American Association of Individual Investors or AAII Sentiment Survey (survey data since 1987) measures the opinions of individual investors by asking them where the market is heading in the next six months. The AAII survey, as of Sept. 21, 2022, shows that individual investors are more bearish today than the GFC (great financial crisis) of 2008 even though corporate earnings, credit spreads, and unemployment data (major economic indicators) are much better today than 2008. Does this mean the investor sentiment pie is over-cooked or can this point toward further pain to come?

Source: https://www.aaii.com/sentimentsurvey/sent_results, https://stockcharts.com/h-sc/ui?s=!AAIIBEAR

Inflation

Inflation is probably one of largest trending buzzwords in 2022 next to #cryptocrash or #recession2022. After two years of a pandemic, $4 trillion in Fed induced “Helicopter Money Drops” in the form of stimulus checks, global supply chain break downs, and a Russian-Ukraine war provoking a spike in energy prices, most global economies find themselves fighting rampant inflation forcing central banks to hike interest rates aggressively for the first time in over a decade. Inflation erodes your purchasing power on the daily necessities from the grocery store to the gas pump. Over the long term, investing in equities have been shown to be a great way to combat inflation. The chart below shows stock market returns over the past 80 years compared to the inflation rate in those years.

Source: https://awealthofcommonsense.com/2021/10/inflation-vs-stock-market-returns/

Market History Matters

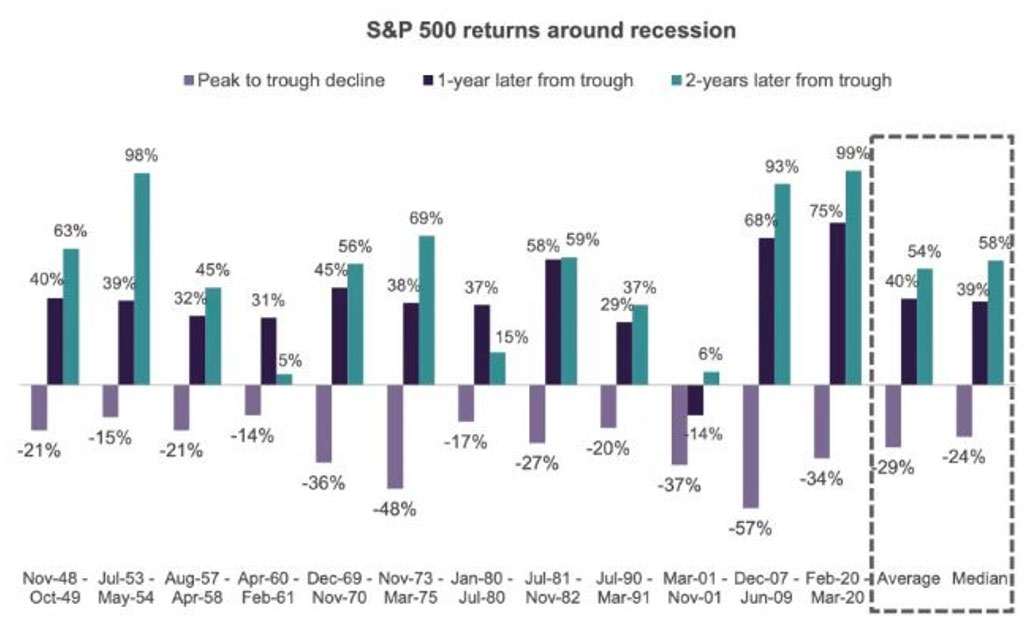

Bear markets are tough to endure and provoke fear, panic, and despair. When in doubt, scroll out, and look at the data. Since WWII, the average decline for the S&P 500 during a recession is approximately -30% with the median decline being -24%. At the time of this article, the S&P is down -24.5% YTD. By historical average standards, the majority of the market pain is in the rearview mirror. The good news is the pendulum of the markets swings both ways. One year after the market troughs the average return of the S&P 500 is up 40% and two years from the trough the S&P is up an average of 54%.

Source: https://finance.yahoo.com/news/history-stocks-recession-102913314.html

Staying Invested

During turbulent market conditions, it is important to know 3 key points.

- Define your investment goals and objectives. Having a good understanding of your investment goals can provide a framework around what type of investments are appropriate for your long term financial needs. Whether you are saving for retirement, building your family nest egg, or saving for your child’s education, defining your goals and desired outcome can pave the way toward your personalized investment strategy.

- Know your time horizon for your investments. Time horizon can help you define what type of investments you want to own and the volatility you are willing to accept for your long term investment plans. A ten year time horizon for your investments may allow you to take more risk in growing your investments than someone with a three to five year investment time horizon.

- Know your risk tolerance. If you don’t have the intestinal fortitude to handle the up’s and downs of the markets, finding investments with a defined maturity date, buffered downside investment strategies, or principal protected investments may help you stay invested without realizing the full brunt of a bear market cycle.

Written by Christopher Brown, CIMA®, CRPC™, Financial Advisor, Synovus Securities, Inc.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.