What strategy can investors employ to reduce portfolio volatility in the current environment?

The stock market is suffering a turbulent 2022 so far; and with inflation still running at a 40-year high, the Federal Reserve locked in a significant rate-hiking cycle and mid-term elections just months away, it's likely the volatility is going to remain for the time being. Investors looking for a smoother market ride should consider buying low-volatility stocks as a way to manage risk. Low-volatility strategies are designed to limit losses during periods of market decline, while still allowing for upside.

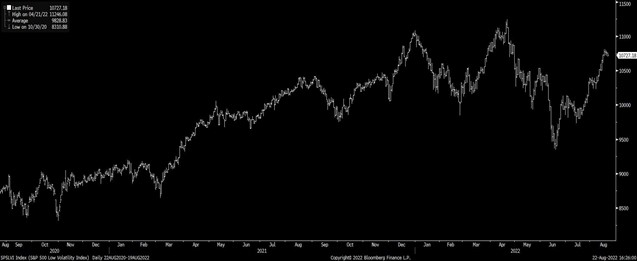

Data shows lower volatility names have typically out-performed the broader market indexes over the long term. The S&P 500 Low Volatility Index, which measures the performance of the 100 least volatile stocks in the S&P 500® based on their historical volatility, averaged a 1.2% risk-adjusted return between 2010 and 2019, compared to a 0.9% return for the S&P 500 Index. Investors should look at low-volatility stocks as a way to add diversification and stability to their portfolios as part of a longer-term strategy. One way for investors to find low-volatility names is to look at beta, which measures how volatile a stock is relative to the broader market. A beta of less than 1.0 theoretically means that the name is less volatile than the S&P 500, while a beta greater than 1.0 points to a stock with more volatility.

Investors should look at low-volatility stocks as a way to add diversification and stability to their portfolios as part of a longer-term strategy.

Investors should look at low-volatility stocks as a way to add diversification and stability to their portfolios as part of a longer-term strategy.

The low-volatility strategy Index is up 22% over the past two years. The rally stalled in June/July but the Index has mostly recovered to its former high set in April. At this point, it’s wise to view the Index’s recent struggles as a breather amid a durable up-trend, not a change of direction. Low-volatility stocks have a lot in their favor, including a still-positive overall trend, supportive relative valuations, and the market's general direction (despite recent strength) remaining down, as evidenced by the S&P 500 continuing to trade below its 200-day moving average.

|

Top Low Volatility Stocks Over Time |

|||

|

Name |

Ticker |

Yield |

Beta |

|

Pepsi |

PEP |

2.45% |

.594 |

|

McDonalds |

MCD |

2.05% |

.635 |

|

Coca-Cola |

KO |

2.68% |

.592 |

|

Hersey Foods |

HSY |

1.57% |

.542 |

|

Proctor Gamble |

PG |

2.40% |

.555 |

|

Colgate Palmolive |

CL |

2.27% |

.410 |

|

Johnson & Johnson |

JNJ |

2.61% |

.476 |

|

Duke Energy |

DUK |

3.60% |

.316 |

|

Southern Co. |

SO |

3.42% |

.608 |

|

Verizon |

VZ |

5.66% |

.177 |

|

Source: Bloomberg |

|

|

|

Industry sectors that typically offer lower price volatility along with solid dividend yields to offset higher interest rates, include Consumer Staples; Health Care; Utilities and Telecom. Examples of some stocks from these sectors that have offered lower price volatility over time are listed in the table above. Whether a low volatility strategy is appropriate for a given investor’s portfolio depends on the investor’s unique risk tolerance and time horizon.

Written by Daniel Morgan, Senior Portfolio Manager

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.