Fed Raises Rates Again in December

The year-end rally in the stock market was fueled by a November Consumer Price Index (CPI) inflation rate of 7.1%, which was below expectations. Suddenly all market pundits were predicting that the Fed would potentially pivot on rate policy next year and stop tightening.

However, the stock market rally was stamped out by the comments emanating from the Federal Reserve’s December meeting. During the recent Federal Reserve Policy meeting Chair Jerome Powell said the policymakers are not close to ending its anti-inflation campaign of interest-rate increases as officials signaled borrowing costs will head higher than investors expect next year. Powell remarked “We still have some ways to go!”

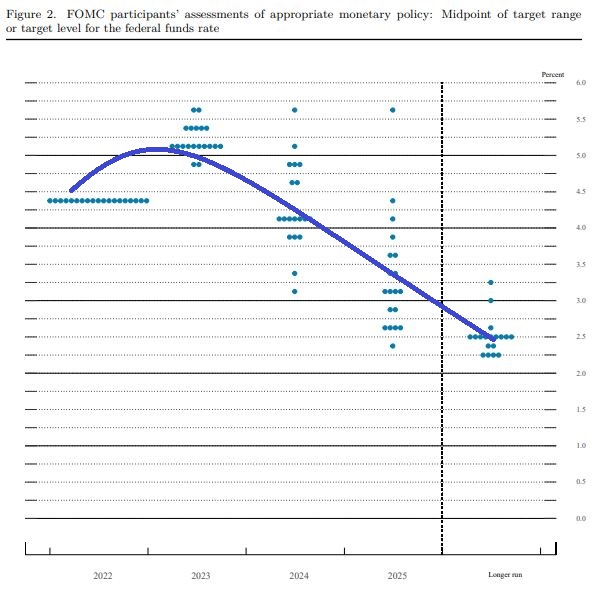

During December’s meeting the Federal Open Market Committee raised its benchmark rate by 50 basis points to a 4.25% to 4.5% target range. Based on the recent dot plot policymakers are now projecting rates would end next year at 5.1%, according to their median forecast, before being cut to 4.1% in 2024 — a higher level than previously indicated.

Powell remarked that the size of the rate increase delivered on Feb. 1 at the Fed’s next meeting would depend on incoming data — leaving the door open to another half-percentage point move or a step down to a quarter point — and he pushed back against bets that the Fed would reverse course next year. The committee anticipates that ongoing increases in the target range are in order to attain a monetary policy that is sufficiently restrictive to move inflation to the previous 2% growth rate.

Chair Jerome Powell said the policymakers are not close to ending its anti-inflation campaign of interest-rate increases

Chair Jerome Powell said the policymakers are not close to ending its anti-inflation campaign of interest-rate increases

Fed officials raised their estimates for the main and core readings of their preferred inflation gauge, the index for personal consumption expenditures (PCE). They now see PCE at 3.1% in 2023 compared with a September estimate of 2.8%, while core — which excludes food and energy — may be 3.5% for next year. During the 3Q22 the PCE stood at 6.3%.

Officials are seeking to slow growth to below its long-term trend to cool the labor market — with job openings still far above the number of unemployed Americans — and reduce pressure on prices that are running well above their 2% inflation target. Wage growth still stands at 5.1%, which creates more buying power for workers fueling inflation. Powell has stated that he willing to allow for the economy to suffer some pain to lower inflation and avoid the mistakes of the 1970s when the Fed prematurely loosened monetary policy allowing inflation to flourish.

Written by Daniel Morgan, Senior Portfolio Manager

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.