Widening the Moat for the S&P 500

As we pass through the halfway point of 2023, the year has been marked by a mixed bag of economic performance accompanied by further economic concerns for the U.S. economy. The S&P 500, the broad benchmark of the U.S. stock market, has experienced both highs and lows over the past 18 months. It reflects the intricate dance between market dynamics of pervasive inflation, low unemployment and a resilient U.S. consumer. We assess the year-to-date (YTD) performance of the S&P 500 and delve into further broad participation in sectors, which up to mid-May has been dominated by the mega cap Tech Sector. As investment outlook remains positive, it’s hard not to acknowledge the narrow participation of seven stocks that have contributed to more than 90% of the S&P performance in 2023.

S&P 500 year-to-date and the magnificent seven

The S&P 500 started the year on a strong note, reflecting optimism and recovery from last year’s bear market. The 2022 laggards have become the belle of the ball for 2023, led by Big Tech and investor excitement over artificial intelligence (AI). A May 16 article by S&P Global stated that only seven stocks had been responsible for the lion’s share of returns for the S&P 500. To quote, “Apple Inc., Alphabet Inc., Meta Platforms Inc., Microsoft Corp., NVIDIA Corp., Amazon.com Inc. and Tesla Inc. have seen significant gains after a bleak 2022, and the collective gains have kept the S&P 500 in positive territory in 2023, with the overall index rising about 7% since the start of the year. Without these seven stocks, which make up nearly 26% of the large-cap index's total weight, the S&P 500 would be down 0.8% on the year, through May 16.”

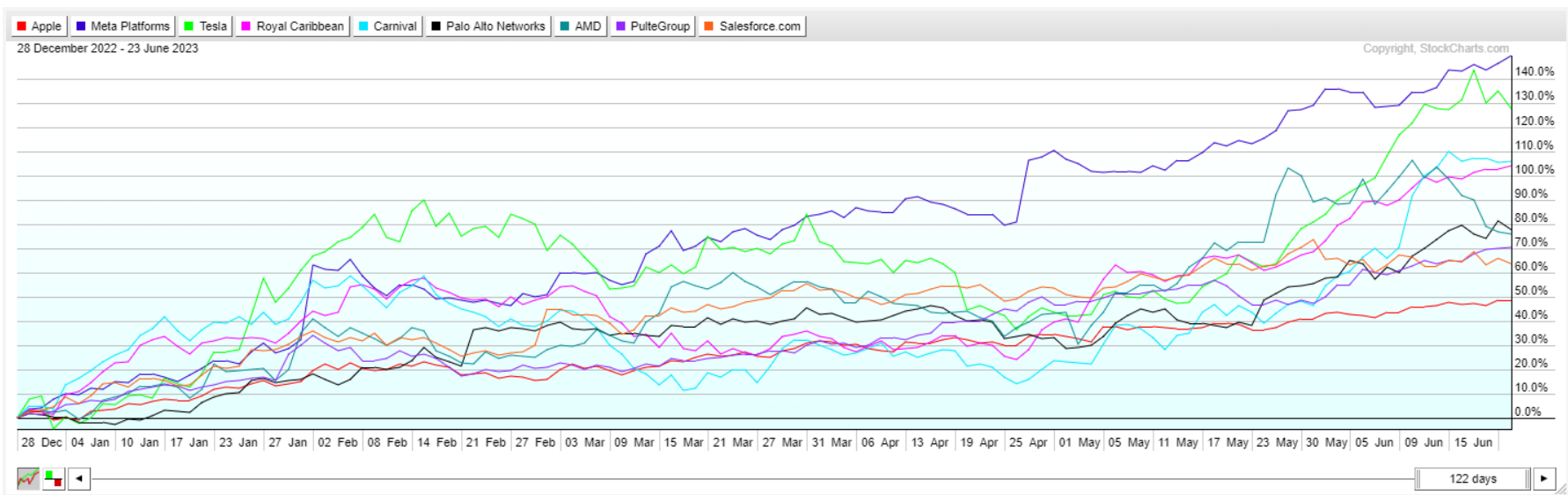

However, since mid-May we have found a broadening of participation and positive returns. As of June 22, Advanced Micro Devices (AMD), Salesforce (CRM), Palo Alto Networks (PANW), Carnival Cruise Lines (CCL), Royal Caribbean Cruises (RCL), Pulte Group (PHM), General Electric (GE), and Norwegian Cruise Lines (NCLH) have bumped their way into the top 10 performers.

Though the magnificent seven comprises a little more than 25% of the S&P 500’s market cap weighting — creating the majority of the YTD upward trend this year — we are starting to see other S&P companies outside the AI craze punch above their weight class to knock Apple, Amazon and Microsoft out of the top 10 YTD performers. This may be due to profit taking, trend exhaustion, or the sobering aspects of a higher-for-longer interest rate environment, which has been made crystal clear by Jerome Powell, Chair of the Federal Reserve of the U.S., on Capitol Hill in mid-June.

Chart 1: S&P Top 2023

Source: https://stockcharts.com/freecharts/perf.php?AAPL,META,TSLA,RCL,CCL,PANW,AMD,PHM,crm

The broadening participation of stocks is a good sign that the bull market of 2023 may not be overextended but just shifting to other areas of the market. The following points are indicators that help provide further insight to additional participation of equities within the broad markets.

Corporate earnings

Q1 2023 corporate earnings were estimated to report a -6% economic growth for Q1 2023, and to many analysts surprise earnings growth were much better than expected. Though still negative, corporate earnings are estimated to be down just less than -2% by the end of June. With a backdrop of a regional banking crisis in March, debt ceiling worries and elevated interest rates not seen in 15 years, one might expect a flat S&P return to just positive for the most optimistic market bull. Instead, the S&P has rallied 14% since the beginning of the year with minor drawdowns in February and March.

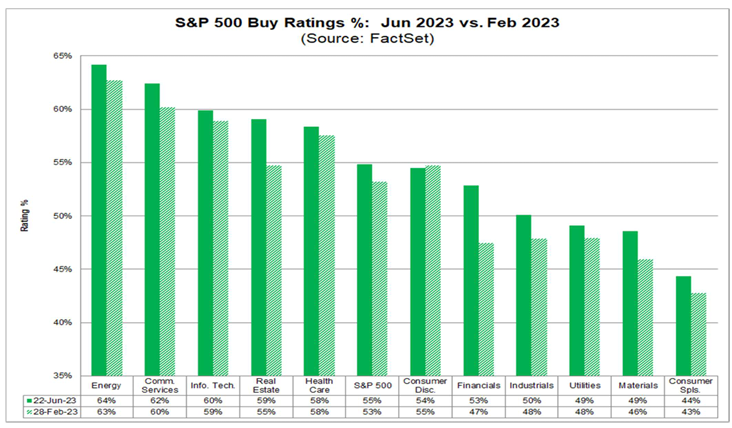

Analyst buy ratings increasing to Q3 of 2023

According to the June 23 FactSet’s Earnings Insight, the percentage of buy ratings is above the five-year (month-end) average of 54.2%, while the percentages of hold and sell ratings are below their five-year (month-end) 39.7% and 6.1% averages, respectively. At the sector level, analysts are most optimistic on Energy (64%), Communications Services (62%) and Information Technology (60%), as these three have the highest percentages of buy ratings compared to analyst buy ratings in Q1 2023. Though Tech and Communications Services have led the 2023 rally thus far, the Energy sector and Real Estate may be injecting momentum as further extensions to the market rally. Due to the nature of the magnificent seven’s cap weightings, further participation may create an asymmetric investment experience for those in broad-based or equal weighted index funds.

Chart 2: S&P Buy Ratings %

Source: https://insight.factset.com/where-are-analysts-most-optimistic-on-ratings-for-sp-500-companies-heading-into-q3

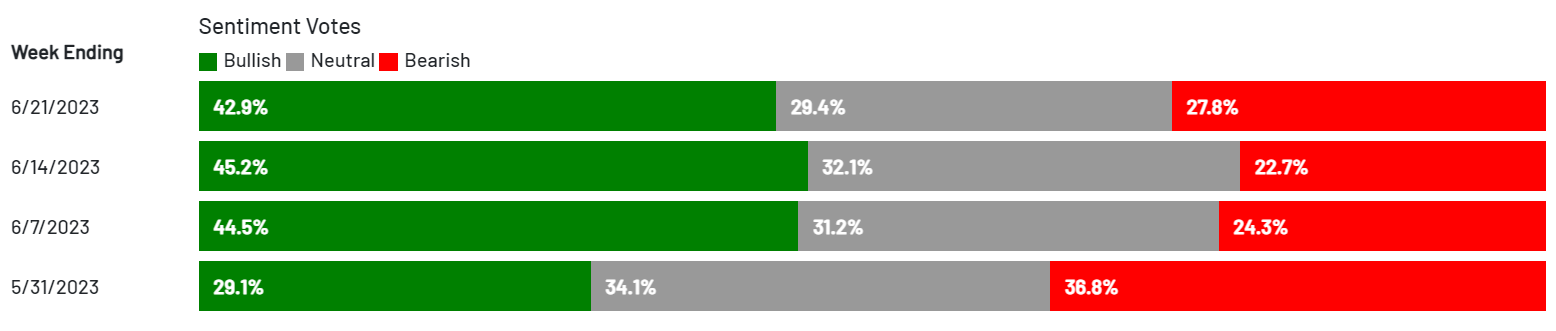

AAII bull/bear sentiment

The AAII Investor Sentiment provides insight from a survey of individual investors and their thoughts on the markets going forward through the next six months. Market optimism slightly declined over the past week to 42.9% but still remains above the historical 37.5% average. Bearish sentiment increased from the previous week to 27.8%. For three consecutive weeks, this is the longest that pessimism has been below 30% since July 2021. The Bull-Bear Spread (bullish minus bearish sentiment) has also been above its long-term 6.4% average for the past three weeks, measuring 15.1%.

Chart 3: Sentiment Votes

Source: https://www.aaii.com/sentimentsurvey

While the markets have displayed resilience since the October 2022 lows, concerns persist for the remainder of the year and into 2024. Inflation, potential for further interest rate hikes and uncertainties around future commercial real estate credit risks continue to cast shadows over the U.S. economic outlook. The “wall of worry” never seems to disappear but may form new bricks in the wall, replacing the worries of quarters past. The wall has always existed; what has changed over the past 20 years is the volume of media investors can access via smartphone apps, and the increase of social media pundits, blogs, and streaming content — that all inform and captivate attention.

The information age can be over-stimulating and it is understandable to see why so many investors create reasons to be under invested and abandon their long-term financial goals. The sensory and information overload can produce paralysis by analysis in realtion to financial nest eggs that investors have worked so hard to accumulate through years of disciplined savings. Navigating these challenges will require continued focus to block out the noise and prudent investment strategies to adjust with an investor’s changing financial needs. Establishing a sound plan with the help of a financial professional may help create clear investment objectives to understand your unique situation, risk tolerance and time horizon to take advantage of future investment opportunities, as well as enduring future market uncertainty.

Christopher Brown, CIMA®, CRPC™ Vice President- Investments

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.