How concerning is the office segment in the Southeast?

I have read several financial news pieces lately in national publications that forecast poor performance of commercial real estate in a post-pandemic world, and it has prompted me to dig deeper into the numbers to try to make some sense of an extremely volatile property market. In general, these articles have focused on two topics, potential oversupply in the multifamily housing sector leading to losses in rents and values, and potential value loss in office properties as hybrid work has negatively impacted demand from office-using companies. In this article, I am going to focus on the latter topic and we will address multifamily in next month’s newsletter.

Many of these articles look back to the Great Financial Crisis of 2008 (GFC) to see how office could perform in a recessionary environment. I was a CRE appraiser back in 2008, and I clearly recall office values in Atlanta dropping 50% over the next two years, and fears of a repeat of that degree of value loss have generated great anxiety in the market. However, the current economic environment (is it a recession?) is nothing at all like the GFC as long as you live in the Southeastern US, and the impact on commercial office values from economic pressures will be far different than what we saw in the region from 2008-2010.

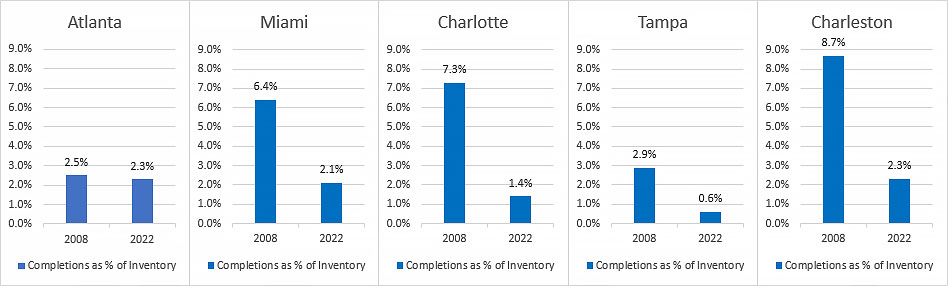

Let’s look at five Southeastern office markets, Miami, Atlanta, Charlotte, Tampa, and Charleston, and hone in on two major measurements: oncoming supply and relative performance to the US as a whole. If there was one factor that destroyed office values in the GFC, it was the crushing wave of oncoming supply that flooded the market at the exact point demand disappeared. Since that point, market experts have determined several ways to track risks related to oversupply but one that is universally accepted is annual deliveries as a percentage of current inventory.

For instance, Atlanta currently has approximately 140 million square feet of office space. If 2.8 million new square feet came onto the market in a particular year, the delivery percentage for that year would be 2%. Figure One shows delivery percentages for our five chosen markets in 2008 (GFC) and 2022 (heading into a FRB-induced downturn). Note that in every case the 2022 delivery percentages are less than those seen in 2008, and in all but one market the difference is significant. What this tells us is that there is no crushing wave of oversupply coming this time, and that should mitigate the risks of value and rent loss.

Figure 1

Top 5 Synovus Office Markets: Completions as % of Inventory

Source: CoStar, 4Q22

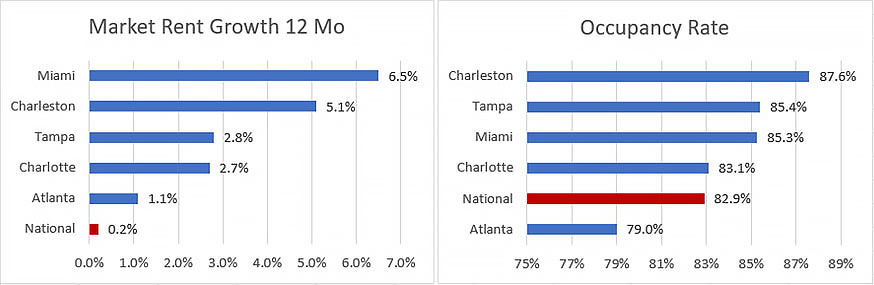

Next, let’s look at relative performance in these five markets when compared to the national average in Figure Two. Regarding occupancy, all but Atlanta boast occupancy levels better than the national average of 82.9%, and three have occupancy levels greater than 85%. Switching to rent growth, note that not only do all five markets show annual gains higher than the national average of 0.2%, but two of our five markets exhibit rent growth greater than 5%, extraordinary numbers given the challenges the office sector has faced coming out of COVID-19’s shadow. What this tells me is that risks to the income side of office valuations are lessened given the extreme growth seen in the Southeast.

Figure 2

Top 5 Synovus Office Markets: Market Rent Growth 12 Mo and Occupancy Rate

Source: CoStar, 4Q22

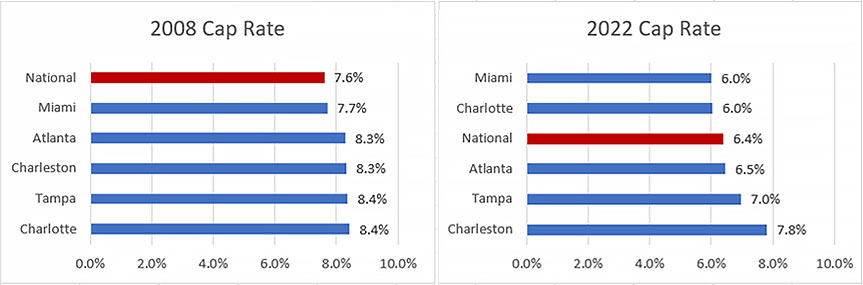

One last metric to consider are capitalization rates (or cap rates). Since values are determined by dividing the net operating income of a property by the cap rate, a higher cap rate means a lower value for a commercial property. In the GFC, the Southeast was seen as a more volatile environment for commercial real estate, and as cap rates are a function of risk, all five of our markets exhibited cap rates higher than the national average (see Figure Three). Since the GFC, two of these markets have reversed trend and feature cap rates that are lower than the US office average, and this translates to lower relative risk and higher relative values than the rest of the nation.

Figure 3

Top 5 Synovus Office Markets: Cap Rates

Source: CoStar, 4Q22

Given these relative metrics, the southeast will not see the type of value loss experienced in the GFC and the regional office sector will perform much better than the national average. Consider these other statistics: Florida is the number one state in the country for producing new businesses and Georgia is number five. New businesses create new office demand. Atlanta, which has lower relative performance numbers in the group we have examined in this article, is actually the third best city in the country for producing office-utilizing jobs and is now considered a global tech hub.

Charleston has become one of the most industrially diversified markets in the country and a major logistics hub. Tampa, due to its high occupancy, high rent growth, and higher relative returns, will continue to grow as investor dollars flood into Florida. Last but certainly not least, Miami is an international powerhouse and, judging by my recent trips to the area, the preferred destination for relocating companies looking to migrate southwards.

I will be the first to admit that hybrid working is a secular trend that is putting negative pressure on values for office properties, and we are currently seeing some degradation in the office market. The 2008 value losses we experienced in the office sector may have bordered on catastrophic, but we knew that as we worked through the recession demand would return, offices would fill up again, and values would recover and begin to grow again. The pandemic has changed that calculus, and workplace trends such as preferences for new space with differentiated amenities and flexible work environments have redefined how much and what type of demand we see for office space. The risks are real, but our region’s operating metrics, risk indicators, and demographic trends should present a safety net for the southeastern office market.

Cal Evans Senior Director Investor Relations & Market Intelligence

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.