Learn

Business Owners: How to Establish a Fair Value and Protect Your Business

By Jarrett E. Hindrew, CFP®, ChFC®, Financial Advisor

In most cases, business owners plan for how they will succeed at growing their business, but is there a plan in place in the event of an owner’s death, incapacitation, divorce, or even retirement? What are the implications of such an event and what does that mean for the continuity of the business and how will the exiting owner or their family be compensated for their interest?

A Buy-Sell Agreement is a legally binding contract that outlines the terms and conditions for the transfer of ownership in a business. The goal of the agreement is to provide clarity and avoid potential disputes by establishing a predetermined process for the transfer of ownership. Having an agreement in place helps maintain the business’ stability by addressing how shares will be transferred, who is eligible to purchase them, and at what price. Additionally, it can prevent conflicts between owners, their families and interested third parties.

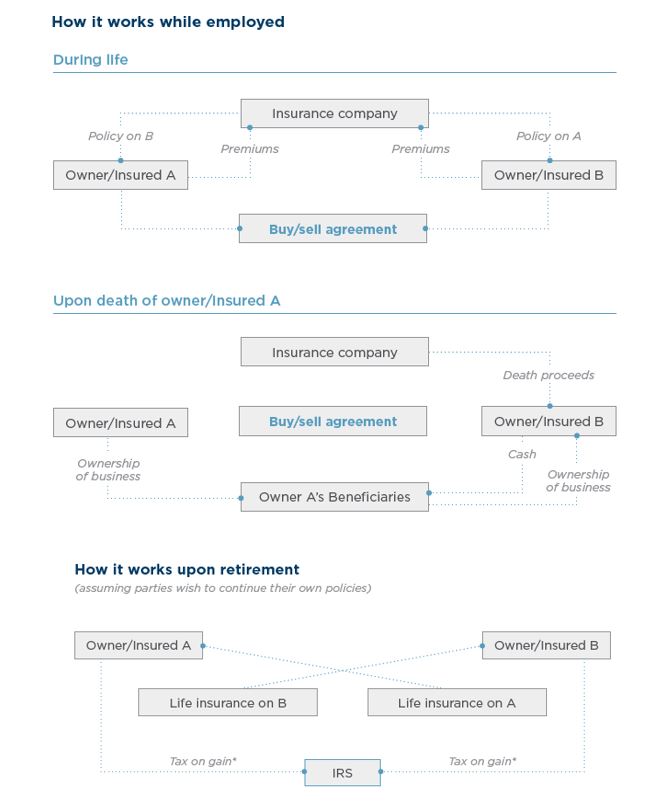

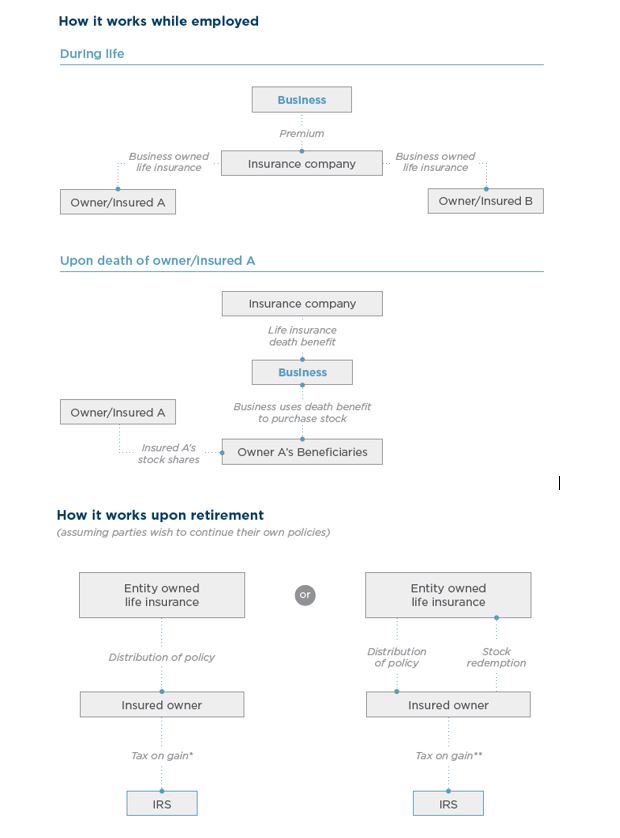

Life insurance is often used as a funding vehicle for Buy-Sell Agreements to quickly provide a lump sum (income-tax free), to immediately purchase the deceased business owner’s interest. Whether the agreement is funded with term or permanent insurance ultimately depends on several specific circumstances pertaining to the business and its owners, but one advantage of using permanent insurance is that the cash value, which is built up over time, can be accessed to purchase an interest in the business following an owner’s retirement or disability.

Chart 1 - Cross Purchase Agreement: Each owner purchases a policy on the life of the other.

Source: Nationwide Advanced Marketing Concepts

Chart 2 - Entity Purchase Agreement: The business entity owns policies on each of the owners.

Source: Nationwide Advanced Marketing Concepts

*If the life insurance policy is transferred to the business owner upon retirement, it is treated as additional income and is taxable as such at the owner’s tax rate at the fair market value of the policy. The entity may be entitled to a deduction.

*If the life insurance is distributed to the owner as a redemption of the owner’s interest/shares in the company, it is taxable as capital gain on the fair market value of the policy.

One of the key aspects of a Buy-Sell Agreement is determining the fair market value of the business. Several valuation methods are commonly used, and the choice depends on various factors such as:

- The nature of the business and its history, from inception to date

- The economic outlook for the overall economy and that particular business or industry

- The capacity of the business to earn a profit

- The ability of the business to pay a dividend

- Whether the business has goodwill or any other intangible value

- Sales of interest in the business and the size of the interest (i.e., minority or controlling) to be sold

- The price of the stock for publicly traded companies in the same or similar line of business

Valuation Methods

How each of these factors are weighted will depend on the specific circumstances of the business. Business valuation methods can be divided into two basic categories: 1) Those focusing on assets and, 2) those focusing on earnings power. Below are frequently employed methods for fair market value determination:

- Asset-Based Valuations: The asset-based valuation method assesses the value of a business based on its net assets. It takes into account tangible assets such as properties, inventory, equipment and those of the intangible variety like patents, trademarks and goodwill. This method is suitable for businesses operating in asset-rich industries. However, it may not accurately represent the ongoing profitability or potential of a business.

- Book Value = Book value of assets – Liabilities

- Adjusted Book Value = Fair Market Value of Assets – Liabilities + Goodwill

- Income-Based Valuation: The income-based valuation method focuses on the future earnings potential of the business. Techniques such as discounted cash flow analysis and capitalization of earnings are employed to project future cash flows and assign a value accordingly. This method is particularly suitable for businesses with a strong customer base, well-established operations and a history of consistent profitability. However, it requires accurate financial forecasting and assumptions about future market conditions.

- Capitalization-Of-Earnings = Average Earnings / Expected Rate of Return

- Discounted Future Earnings = Estimated Future Earnings / Expected Rate of Return

- Market-Based Valuation: The market-based valuation method involves comparing the business being valued to similar businesses that have been recently sold or are publicly traded. This approach utilizes market data and economic indicators to estimate the fair market value. It considers factors such as revenue, profit margin, growth prospects and market share. The valuation is based on multiples of earnings, sales, or assets. This method provides a more accurate reflection of the market value; however, it heavily relies on the availability of comparable transaction data.

It should be noted that these valuation methods can be used individually or in combination, depending on the circumstances and preferences of the parties involved.

It is important to regularly review the adequacy of insurance coverage with your financial team (i.e., financial planner, CPA, attorney) and update the agreement as the business grows and/or should the ownership structure change. Having a well-documented Buy-Sell Agreement and determining the fair market value of the business by using appropriate valuation methods such as asset-based, income-based, or market-based, enables stakeholders to establish a fair and credible value and ensures the continuity of the business should a business owner decides to leave, retire, or faces an unfortunate event.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.