Learn

Fed Update

Eric Krueger, Synovus Trust Senior Portfolio Manager

It is time once again to delve into a recent Federal Reserve decision and its implications for markets. The Fed has been at the center of attention this year due to its focus on "data dependence," which has led the markets to react to every key inflation and labor release. In its most recent decision, the Fed opted to keep rates unchanged but changed its tone on the outlook, a move commonly referred to as the "Fed Pivot.” Both the Dot Plot and Q&A session were more dovish than anticipated by the market.

FOMC Meeting and Press Conference

The Fed has raised rates over the past 18 months to 5.25-5.50% to curb inflation and prevent it from spiraling out of control. Per Federal Reserve Chair Jerome Powell’s script from the press conference at the December 13 Federal Open Market Committee (FOMC) meeting:

“Inflation has eased from its highs, and this has come without a significant increase in unemployment. That is very good news. But inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain. As we look ahead to next year, I want to assure the American people that we are fully committed to returning inflation to our 2 percent goal. Restoring price stability is essential to achieve a sustained period of strong labor market conditions that benefit all.”1

If you had heard him read the press statement you would not get the obvious sense of a Fed pivot, but during the Q&A he answered a question about whether the Fed was done with hikes. He responded: “So we added the word “any” as an acknowledgement that we believe that we are likely at or near the peak rate for this cycle.”2

This, of course, led the market on a huge rally, both in equities and fixed income.

SEP (Dot Plots)

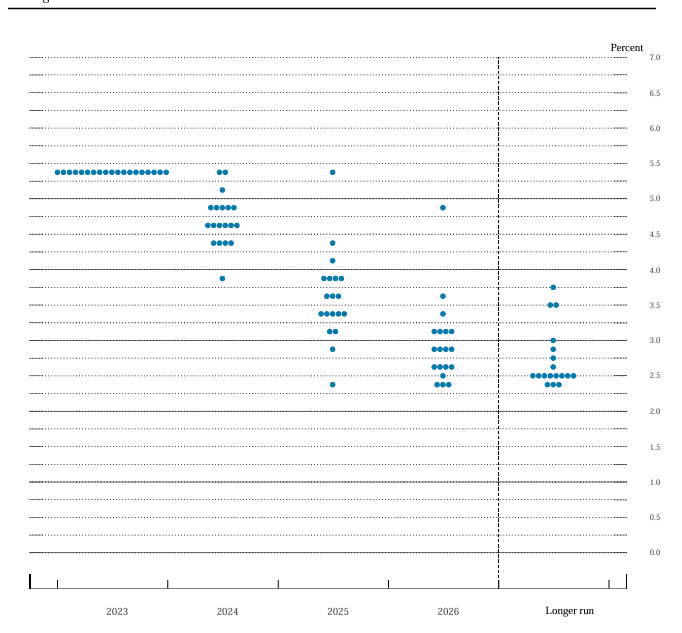

While the markets anticipated the rate decision, the message from the committee’s economic forecasts was more dovish than expected. The Summary of Economic Projections (SEP) revealed that, given inflation slowing, the committee removed the one rate hike penciled in for 2023. It also raised next year’s rate decreases to 75 basis points (bps) from 50 bps.

The market, however, expects double the number of cuts (a total of six) from the Fed:

.png)

Inflation

Inflation has been a key driver of Fed expectations this cycle, with the labor market being the other significant factor. The market and most of Wall Street have embraced the soft-landing narrative, so any unexpected persistence in inflation could dampen expectations and result in fewer rate cuts next year. The St. Louis Fed's economic data site provides a graph illustrating the potential stickiness of core CPI.:

A crucial element in the narrative of lower inflation relates to rents, as shelter-related data accounts for approximately 40% of Core CPI. The shelter component has remained higher than what popular rent data (e.g., Zillow, others, etc.) would forecast. Monitoring CPI and PCE data in 2024’s first quarter will be essential to assess the situation accurately.

Conclusion

In conclusion, the Federal Reserve's recent decision and commentary suggest that it is likely finished with rate hikes, which is favorable news for bond holders. Given the higher coupons observed this year, high-quality bonds continue to be attractive at these levels. On the equity side, the S&P 500 unexpectedly increased by 25%. Much of this increase can be attributed to the "Magnificent 7," which are seven large-cap tech companies viewed as benefiting from artificial intelligence (AI). A broader market breadth is a positive sign, as the stock market performs better when more stocks participate rather than relying on just a few rallying stocks. Maintaining a strategic asset allocation and rebalancing when necessary are critical disciplines for long-term success.

If you have any questions or would like to discuss how these developments may impact your portfolio, please reach out to your Synovus advisor.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.