Learn

What a Government Shutdown Could Mean for Investors

By Eric Krueger, Synovus Trust Senior Portfolio Manager

A divided U.S. Congress is facing a September 30 deadline to find agreement on a variety of spending bills to avoid a government shutdown. Economists estimate a shutdown would shave 0.05% to 0.2% off gross domestic product (GDP) per week and would affect employment and data releases. However, activity would likely be made up in the following quarter’s activity. Historically, government shutdowns have not been big market movers.

Government Shutdowns

Why do shutdowns happen? Each year, Congress passes appropriations bills to keep the government funded. If this is not completed by the start of the new fiscal year (October 1), there are two clear options:

- Congress passes a continuing resolution (CR), which is an expedient funding bill that keeps spending levels at previous levels established the prior year.

- Or a government shutdown occurs.

What makes a shutdown more likely this time? While not a certainty, several key items tilt the odds in its favor, including the following:

- The recent passing of the debt limit.

- The relatively small initial impact of a temporary shutdown.

- The ratings downgrade from Fitch Ratings on August 1, giving conservatives more leverage in budget negotiations.

- The short timeframe to get spending bills passed.

There have been four shutdowns that have lasted for more than a day. In 1995-1996 there were two separate shutdowns that, in total, lasted 26 days. In 2013, disagreements over funding the Affordable Care Act led to a 16-day closure. Most recent, in 2018-2019, the government closed for full 35 days.

Economic Impact

The economic impact of past shutdowns has been limited and transient because pay to non-essential federal employees is deferred and will be paid back in full when the shutdown ends. There are three types of Federal spending, and only “discretionary” spending is affected. Mandatory items like Medicare and Social Security are excluded from the shutdown, as are interest or principal payments on debt. Estimates from economists as well as research from the Fed on past shutdowns give estimates in the 0.05% to 0.2% per week hit to GDP.

Key Dates

September 5: Congress is currently on recess and the U.S. Senate starts back, allowing it only four weeks to pass the needed spending approvals.

September 12: The U.S. House of Representatives due to return, leaving just three weeks before the fiscal year ends.

October 1: Deadline to pass spending bills or a continuing resolution. If neither are completed, the government goes into a shutdown.

January 1, 2024: If the appropriation bills or CR have not been passed, the spending caps must cut 1% from 2023 discretionary spending levels. While the spending caps are changed, Congress has until April 30, 2024 to act.

April 30, 2024: The above mentioned 1% discretionary cut comes into effect if Congress fails to pass a full-year CR or all appropriation bills.

Market Impact

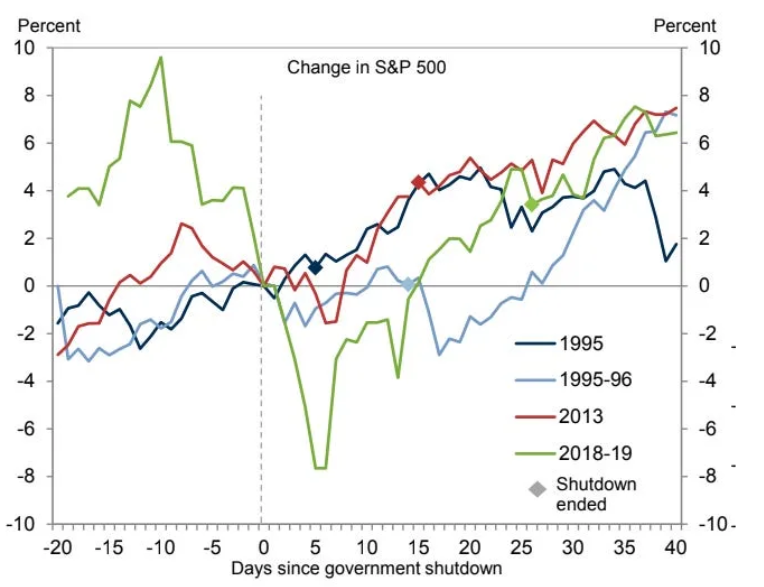

While the stock market usually initially declines around government shutdowns, it often rebounds quickly (see chart below), while treasury yields have historically fallen. The caveat is that given that we only have four episodes, the data is limited, and each event has their own unique backdrop.

Source: Yahoo Finance and Goldman Sachs Global Investment Research

The bottom line is that while a potential government shutdown is worth monitoring, there is no need to be frightened. Seasonally, this is the weakest part of the year for the stock market and 2023 may prove to be no different given the macro environment. Regarding government bonds, the U.S. Department of the Treasury has both the funds and authority to pay U.S. bond holders if the government goes into shutdown mode. Do not let the potential headlines deter you from your long-term investment plan, while rebalancing as needed to keep risks within tolerance.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.