Learn

Financial Planners Corner!

Jarrett E. Hindrew, CFP®, ChFC®, CLU®, Financial Advisor

Financial planning during presidential election years can be influenced by the potential economic and market impact of the election cycle. Here are some key points to consider when incorporating presidential election years into financial planning:

-

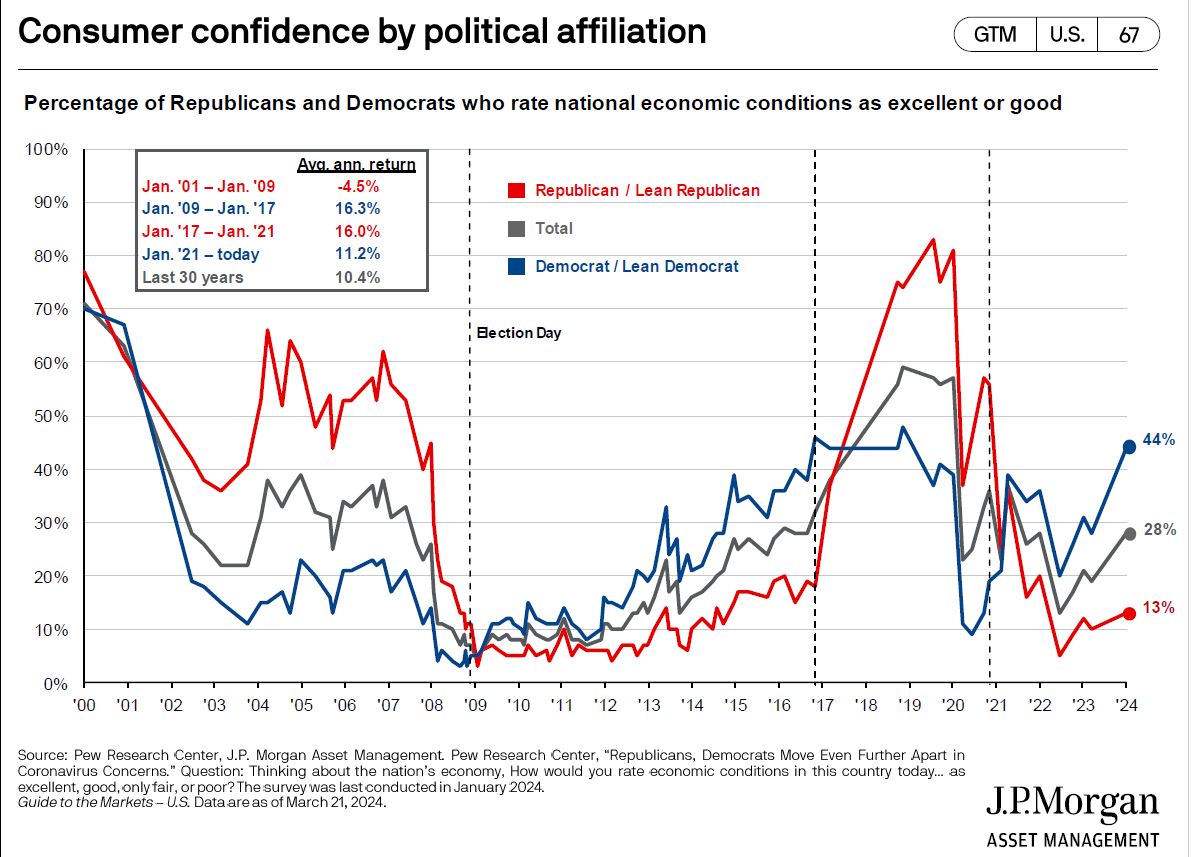

Market Volatility: Presidential elections often bring heightened uncertainty, which can lead to increased market volatility. Political landscapes can be unpredictable, and outcomes may not always align with expectations. It's essential to stay focused on your long-term financial goals and avoid making impulsive investment decisions based solely on election-related news. Political views can be emotionally charged, leading to biased decision-making. It's essential to separate personal beliefs from investment decisions to ensure a rational and disciplined approach to managing your portfolio.

Source: Pew Research Center, J.P. Morgan Asset Management -

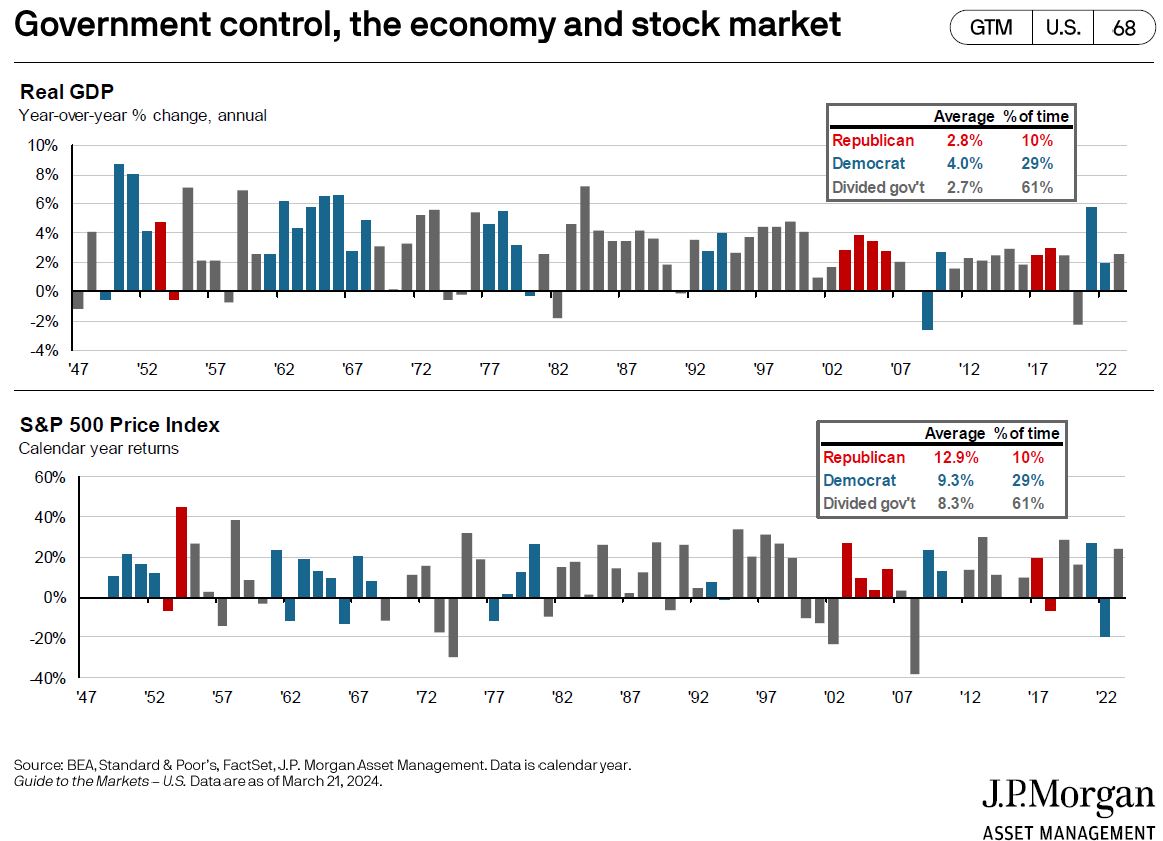

Historical Trends: While past performance is not indicative of future results, historical data shows that markets have generally experienced increased volatility in the months leading up to, and following, presidential elections. Understanding these historical trends can help you prepare for potential fluctuations. Financial markets are generally efficient at quickly incorporating new information, including political developments. Trying to time the market based on political events can be challenging and may lead to missed opportunities or unnecessary risks. Rather than reacting to short-term political events, it's advisable to focus on the underlying fundamentals of the companies and investments in your portfolio. Factors like earnings growth, valuation and market trends are often more critical drivers of long-term investment success.

Source: BEA, Standard & Poor’s, FactSet, J.P. Morgan Asset Management -

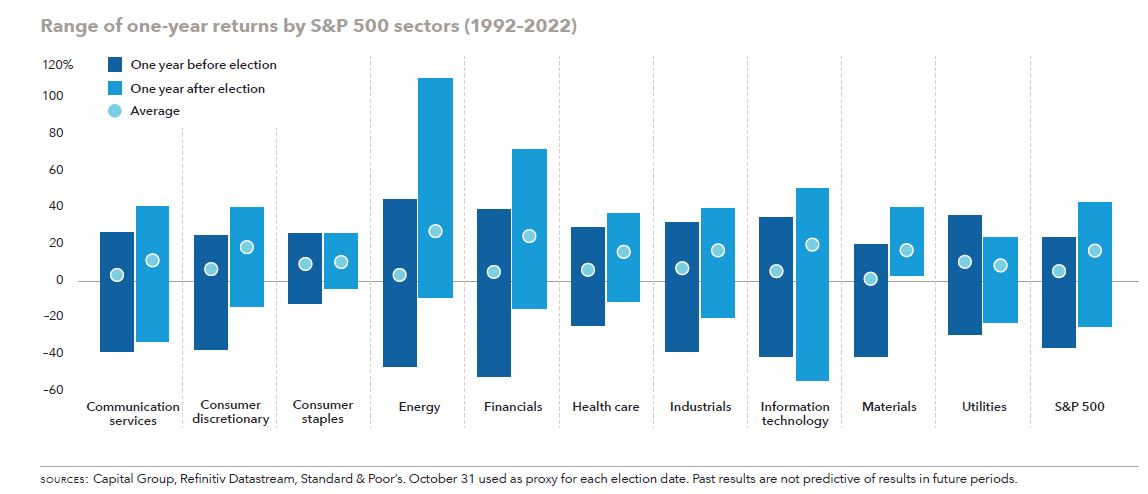

Diversification: Political events and policies can affect different sectors and industries in various ways. Diversifying your investment portfolio across asset classes can help mitigate the risks associated with any single political outcome. Maintaining a well-diversified investment portfolio can help mitigate the impact of market volatility during election years.

Source: Capital Group, Refinitiv Datastream, Standard & Poor’s -

Review Your Financial Plan: It's a good idea to review your financial plan during an election year to ensure it remains aligned with your long-term objectives, risk tolerance and time horizon. Consider consulting with a financial advisor to assess any necessary adjustments to your plan.

-

Tax Considerations: Presidential elections can bring potential changes to tax policies and regulations. Stay informed about any proposed tax reforms that could impact your financial situation and consider adjusting your tax planning strategies accordingly.

-

Stay Informed: Keep yourself informed about the candidates' economic policies and how they may affect various sectors of the economy. Understanding the potential implications of different policy measures can help you make more informed financial decisions.

-

Maintain a Long-Term Perspective: While election years can introduce short-term uncertainty, it's important to remember that successful financial planning is built on a long-term perspective. Focus on your financial goals, stick to your investment strategy, and avoid making hasty decisions based on short-term events.

Successful investing is often about maintaining a long-term perspective and staying focused on your financial goals. Short-term political changes may create market volatility, but it's important to remember that long-term economic trends and fundamentals have a more significant impact on investment returns.

By incorporating these considerations into your financial planning during presidential election years, you can navigate potential market volatility and economic changes more effectively. Remember that working with a financial advisor can provide valuable guidance and support in developing a strategy that aligns with your goals and risk tolerance.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.