Learn

The Personal Trust Corner: A J.D.’s Perspective

By Amy Piedmont, J.D., LLM, Vice President, Sr. Trust Relationship Manager and

Katherine “Kate” Gambill, J.D., Vice President, Sr. Trust Relationship Manager

Navigating the Maze of Estate and Gift Tax Exemption: Charitable Giving

In our series, “The Personal Trust Corner: A J.D.’s Perspective,” we aim to spotlight one planning strategy each month in response to the ever-changing Estate Tax Laws. These strategies can be employed individually or in combination. This month we focus on unveiling the power of charitable giving tools for wealth management and tax planning.

As a high-net-worth individual or couple, it's natural to want your wealth to not only serve you in your lifetime but also to leave a legacy for future generations. Estate planning is crucial in this process, enabling the implementation of strategies that ensure your wealth is well managed and preserved and not depleted by large tax liabilities at your death. This month, we're shining a light on some powerful charitable giving tools that can help you achieve this goal.

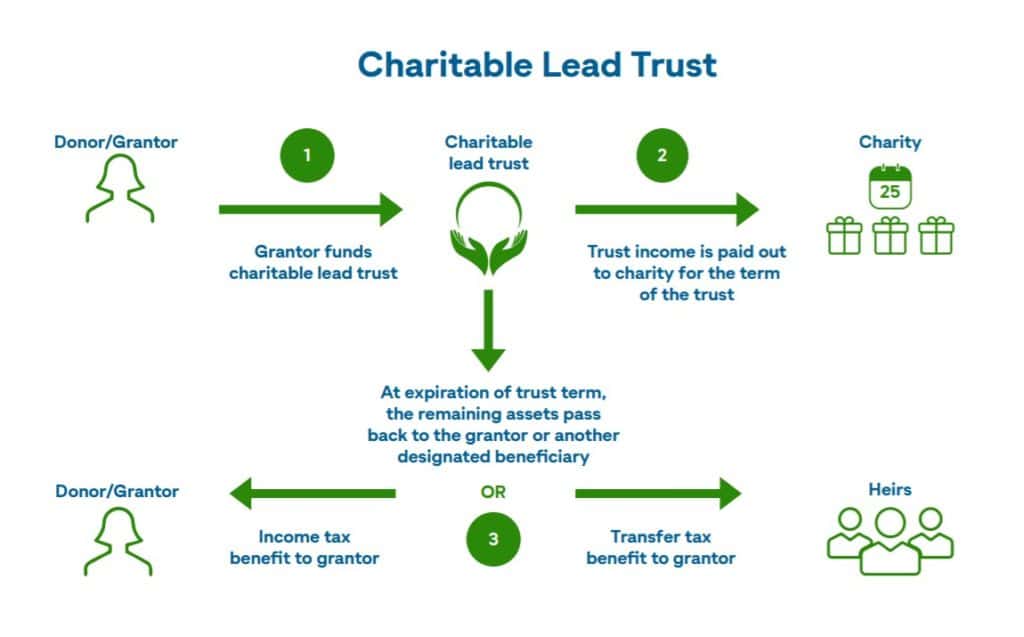

The Magic of Charitable Lead Trusts (CLTs)

If your heart leans towards philanthropy, a CLT could be an excellent tool for you. It allows you to give back to your chosen charity by providing them with an income stream for a specified period. After this period, the remainder of the trust assets either come back to you or are distributed to non-charitable beneficiaries.

For high-net-worth individuals, a CLT is a smart strategy to reduce or even eliminate estate and gift taxes on assets eventually passed to heirs, thanks to a portion of the assets going to charitable organizations. High income-generating assets are ideal for a CLT as they can be positioned to provide a steady income stream to a charity.

However, remember that once established, a CLT is irrevocable. This means the decision to transfer assets is final and you would not have access to the assets during the trust term.

The Charitable Lead Annuity Trust (CLAT) Strategy

An example of a CLT is the CLAT wherein the Grantor transfers assets to the trust, which will not be subject the federal gift tax as the trust is a charitable trust. The CLAT then distributes payments annually to one or multiple qualified charities for a set term, usually at least 12 years. At the end of the charitable term, the remainder can be held in trust or distributed outright to individual beneficiaries without any federal estate tax consideration. The income of the trust will be taxed differently depending on Grantor trust status.

A CLAT may specify if payments will be a determined amount or increase by a designated percent of the trust’s income. The trust can also set a structure, where the charity receives a lesser amount toward the end of the term, with one large payment in the final term year.

A CLAT is a preferred tool for high-net-worth individuals wanting to transfer wealth to their family without using any estate and gift tax exemption. CLATs can be created during one's lifetime (Lifetime CLAT) or at death (Testamentary CLAT), offering opportunities to lower income tax or estate tax liability respectively. It allows assets to pass to family beneficiaries at the end of the designated charitable term.

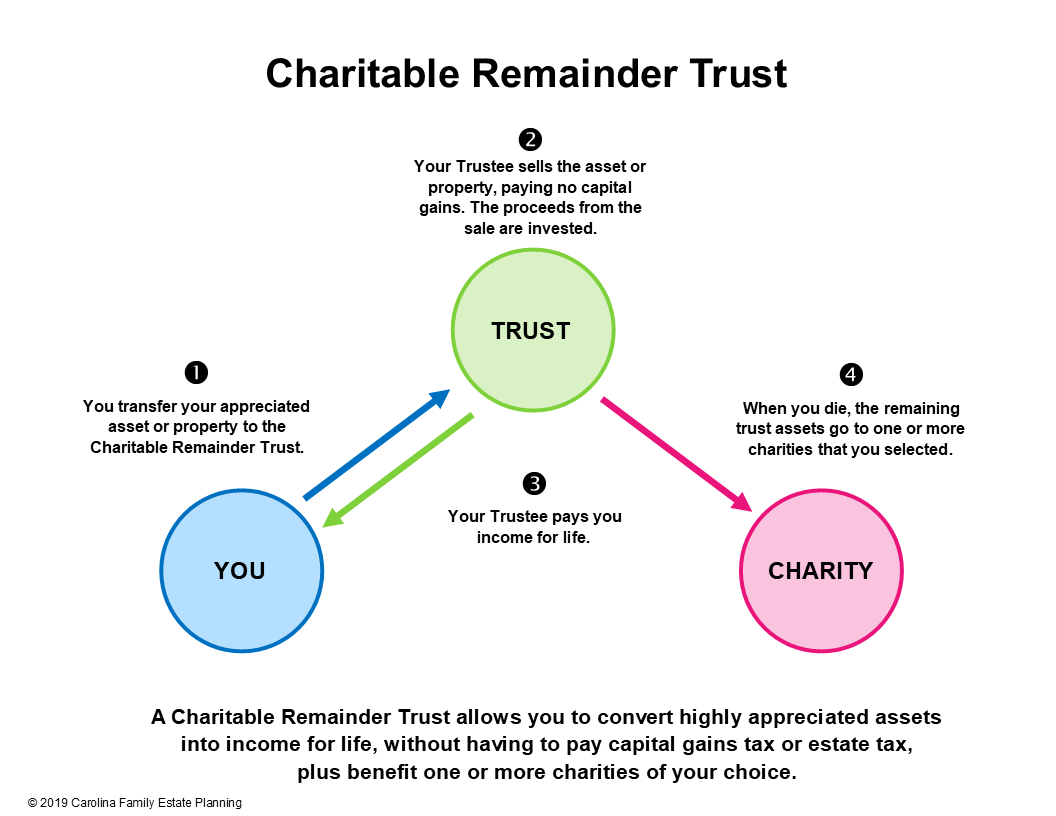

The Versatility of Charitable Remainder Trusts (CRTs)

For those seeking a steady income stream for themselves or for a non-charitable beneficiary, while also benefiting a chosen charity, a CRT is a valuable tool. The term of a CRT can be set for your lifetime or a maximum of 20 years, with the remainder passing to a qualified charity at the end of the set term. The value of the charitable remainder interest should be equal to at least 10% of the initial value of the assets transferred into the trust.

CRTs are particularly effective when funded with highly appreciated assets. The Grantor can transfer the highly appreciated asset to the CRT. The Trustee of the CRT can then sell these assets without incurring capital gains tax, allowing the proceeds to be reinvested to generate an income stream.

By donating the appreciated asset before the sale, the Donor avoids incurring capital gains as well as reduces any potential estate tax liability since the asset will not be included in his estate at death.

Are you projected to have a substantial tax liability this year? A CRT contribution can provide a current year income tax deduction while fulfilling your philanthropic goals by way of leaving a remainder interest to charity.

The Charitable Remainder Annuity Trust (CRAT)

The Charitable Remainder Annuity Trust (CRAT) is a CRT that offers payments to the donor or other non-charitable beneficiaries, with the remainder interest eventually going to a qualified charity. The term of the CRAT is set for the individual’s lifetime or the maximum of 20 years. A CRAT also allows for a combination of the two, the longer of the lifetime of one or more individuals or a term of up to 20 years. At least 10% of the original value of the assets transferred to the trust must go to charity. Further, there must be a 5% probability that the trust will be paid out entirely by the end of the term. However, no future contributions are permitted in a CRAT. Therefore, this irrevocable tool should be considered carefully before execution.

The CRAT is a fantastic tool for a charitably inclined Donor who owns appreciated assets looking for opportunities for annual payments, to defer income tax, and to receive a tax deduction on the current value of the charity’s remainder interest. The donor or other non-charitable beneficiaries receive an annual payment for the duration of the term. If there is an independent trustee, a spray power may be added so that annual payments are available to multiple beneficiaries in the trustee's discretion. The CRAT deduction is the fair market value of the donated assets less the current value of the individual annuity, with some limitations. The Donor may also carry over excess charitable deductions for up to five years.

Exploring Variations: CRUT and NIMCRUT

The Charitable Remainder Unitrust (CRUT) and the Net Income Makeup Charitable Remainder Unitrust (NIMCRUT) are variations of CRTs, designed for those keen on ensuring the charity receives their intended share at the end of the term. Here, the individual will receive a percentage of the trust value, reassessed yearly, and future contributions may be permissible. These trusts offer flexibility in payment and growth options, but careful planning and drafting of documents is essential to avoid any self-dealing issues.

The Net Income Makeup Charitable Remainder Unitrust (NIMCRUT) is a CRUT with a few added specificities. The NIMCRUT allows the donor, or non-charitable recipient, to postpone payments by giving the option to take the designated payment or a percentage, whichever is less. The benefit here is that the trust can continue appreciating, tax free. To ensure value grows tax free, the payout percentage can be specified higher than the anticipated growth rate of the trust. Sometimes this will allow the individual recipients more than the charity.

Your attorney will draft your documents carefully as to avoid any self-dealing issues. If the CRUT or NIMCRUT is formed by a trust that is not included in an individual’s estate for estate tax purposes, it will receive no tax deductions and the self-dealing rules do not apply.

Conclusion

These charitable giving tools offer a host of benefits for you, your heirs, and your chosen charities. However, they come with their own set of rules, implications, and complexities. Working with a knowledgeable attorney is key to ensuring your estate planning goals are met effectively and efficiently.

Remember, your wealth is not just about financial security – it's also about the legacy you leave behind. Charitable giving tools are a great way to balance both these aspects, ensuring your wealth serves you, your heirs and your goals.

In the world of estate and gift tax exemption, challenges and opportunities abound. Tools like charitable giving can be instrumental in effective estate planning, but they demand careful consideration and strategic planning. At Personal Trust, our commitment is to guide you through this intricate landscape, ensuring the best possible outcomes.

Please reach out to our Senior Trust Relationship Managers: Amy Piedmont, J.D., LLM, Vice President, in Pensacola, Florida and Katherine Gambill, J.D., Vice President, in Atlanta with any questions or to start a conversation regarding estate planning. We welcome the opportunity to introduce you to how Synovus Trust Company can serve your needs.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.