Learn

Bitcoin: A December to Remember or the Trade to Fade?

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

After the November elections, the crypto markets have been one of the fastest-moving asset classes and Bitcoin did surpass the $100,000 mark, a feat that many crypto enthusiasts have been waiting for since its inception. Bitcoin speculators became extremely bullish with a pro-Bitcoin U.S. President-elect Donald Trump, who will be at the helm of the White House. Trump had attended the Bitcoin conference in Nashville on his campaign trail in July stating that he would support Bitcoin and the crypto industry, promising to end stifling regulation imposed by Gary Glensler, who recently resigned as Chairman of the Security and Exchange Commission (SEC).

As you may know, Synovus does not currently trade in crypto currency but we thought you might appreciate information about it.

Bitcoin was up more 47% since the election and 110% year to date, as of the time of this writing. I wanted to provide a bit context of additional contributing factors that provided further tailwinds to the crypto asset class as it was borne out of obscurity as a white paper for a new electronic cash system during the great financial crisis of 2008. This is not a deep dive in the technical aspects of Bitcoin and the crypto markets but, rather, a few recent occurrences that I find relevant to the current investor sentiment.

The crypto markets were all but left for dead after the November 2022 collapse of FTX, one of the largest crypto exchanges that was shut down after a federal investigation, finding that it was involved in a Ponzi scheme that used its own FTT token to prop up its speculative investments, while losing almost $8 billion of customer’s deposits. Binance, the second-largest crypto exchange, was shut down for similar reasons as many investors were left with fractions of their deposited funds. Any consumer trust in the legitimacy of crypto exchanges or cryptocurrencies had been completely decimated; it resulted in a 77% drawdown from $67,000 in November 2021 and down to $16,000 in November 2022. Coinbase (Ticker: COIN), one of the last standing and now largest decentralized crypto exchanges, had suffered a 91% drawdown during the same time. So, what changed in 2023? Did everyone just forget?

Bitcoin Correlation to the Bull Market

The S&P 500 and NASDAQ represents the top publicly traded growth firms in the U.S. As the markets started to recover during the first half of 2023, a new technology revival emerged as ChatGPT was introduced to the world. That ushered in a new risk appetite for high-powered computing, graphics processing units (GPUs) and semiconductors investments. This catalyst moved the markets back into a renewed bull market cycle, replacing the FAANG stocks with the Magnificent 7. Bitcoin had reestablished itself as the leading crypto asset and correlated closely to the movements of our new artificial intelligence (AI) tech revival.

Omkar Godbole, co-managing editor at CoinDesk's Markets team, said in a February 2023 article: “The 90-day correlation coefficient between the crypto market's total capitalization with Nasdaq has risen from -0.12 to 0.74 in four weeks. In other words, the crypto market is again moving in tandem with technology stocks. On days when technology stocks trade higher, cryptocurrencies, including bitcoin (BTC) and ether (ETH), are likely to do the same. Conversely, a decline in technology stocks could drag the crypto market lower.”1

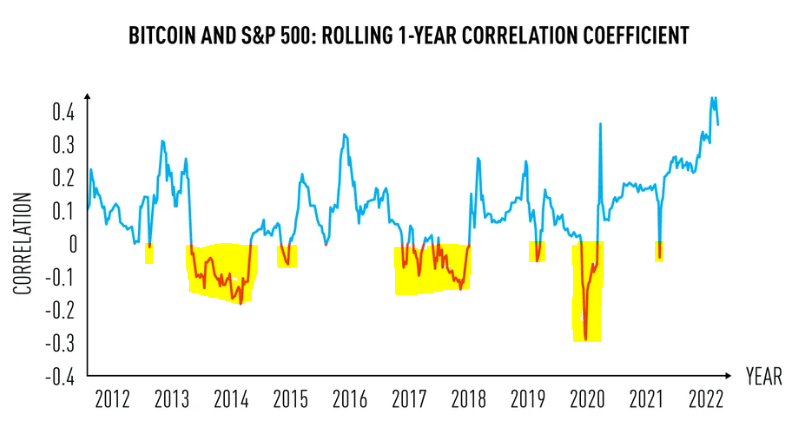

This may also indicate that Bitcoin prices may be influenced by macroeconomic factors such as U.S. inflation (CPI) numbers and monetary policy changes by the Federal Reserve since many Bitcoin investors own the digital asset as a hedge to devalued U.S. dollar. Below shows a long-term positive and negative correlations between Bitcoin and the S&P 500 over the past 10 years. Based on this long-term chart, as Bitcoin becomes a more mature asset class, the negative correlation of Bitcoin versus the S&P 500 has become less and less over the recent years. This positive correlation may continue due to the abundance of tech stocks represented in the S&P 500 index. Tech stocks represent approximately one-third of the weighting of the S&P 500 in 2024.

Bitcoin Goes Mainstream as ETF is Approved by SEC

On January 10, the SEC approved a spot Bitcoin exchange traded fund (ETF), making it available for investors to buy in regulated brokerage accounts. If you would like to read more on this event, I covered this launch of the “newborn nine” in my February 2024 market update. This was one additional step to bringing Bitcoin out of the decentralized trading apps that, honestly, still remain a bit difficult to maneuver for the non-tech savvy. Rather, Bitcoin can now be purchased as an ETF and held in any brokerage or self-directed IRA account. Since the launch of the 10 various Bitcoin ETFs over this past year, the asset class has soared to just over the $100 billion in asset. In a recent November 22 Yahoo Finance article,2 it was reported, “Bitcoin (BTC) has reached a new milestone; as of Nov. 21, 2024, Bitcoin ETFs have received an inflow that now totals over $104 billion in assets, fueled by a strong market boost following the U.S. presidential election.”2

Just to understand, the enormity of the total market cap of the Bitcoin ETFs are similar market caps of companies like Intel, Boeing, Southern Company and Nike. The ETFs are not just comprised of retail investors, but the large money of institutional investors such as hedge funds, pensions and endowment funds.

As exciting as this new asset class can be for investors looking to add extra fire power to the growth of their portfolios, I would advise to take caution when adding any new asset class exposure to your portfolio. Do your homework in finding what would be the best strategy for your own personalized investment goals. Knowing your risk tolerance and investment objectives are the first determining factors to consider before investing. I have been following Bitcoin and the crypto markets for more than six years and though the industry has been riddled with its share of fraudsters and Ponzi schemes, Bitcoin’s resilience has proved to be more than a “Tulip-mania” investment fad. As we enter 2025, Bitcoin has many tailwinds that can create a prosperous outcome for long-term investors. But this does not mean the investment risk disappears. The risk becomes masked by greed and exuberance. Any experienced long-term investor knows that there are always surprises in the markets that may introduce unforeseen risk to your investment plans. Morgan Housel, author of the best-seller “Psychology of Money” has one of my favorite definitions of risk, especially when I think of speculative asset classes like Bitcoin. “Risk is what’s left over when you think you’ve thought of everything.”

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- Omkar Godbole, “Correlation Between Crypto Market and Nasdaq Turns Positive Ahead of U.S. CPI Release,” Coindesk, published February 13, 2023. Accessed November 26, 2024. Back

- “Bitcoin ETFs Shatter Records, Surpassing $100 Billion in Assets as Crypto Price Soars Toward $100K,” Yahoo! Finance, published November 22, 2024. Accessed November 26, 2024. Back