Learn

SEC Approves Bitcoin ETF: A Buy the Rumor, Sell the News Event?

By Christopher Brown, CIMA®, CRPC™

Vice President — Investments

On January 10 the U.S. Securities and Exchange Commission (SEC) approved a spot Bitcoin Exchange Traded Fund (ETF). Prior to this approval investors were limited owning Bitcoin (BTC) directly through an unregulated cryptocurrency exchange. Investors could access publicly traded firms whose business models worked directly with Bitcoin as a blockchain company or as a Bitcoin proxy in firms like Microstrategy (ticker: MSTR), Marathon Digital (MARA), or Riot Platforms (RIOT), where they hold large sums of Bitcoin as part of their corporate treasury. These companies were considered “Bitcoin adjacent” and did not represent direct ownership of Bitcoin, even though their market prices would rise and fall in the similar direction of BTC. This is similar to the way an oil refinery stock price would follow in a similar direction to the price of oil.

Grayscale Opened the Door

The top player in the cryptocurrency space that offered the closest access to Bitcoin directly to client brokerage accounts was Grayscale’s Bitcoin Investment Trust (GBTC). Though GBTC traded similarly to an ETF, you could only buy and sell GBTC through the “over-the-counter” exchanges (OTC). These exchanges are more opaque in their regulatory standards and often had lower trade volume, as well as liquidity in their stock and ETF offerings. If you have ever thrown caution to the wind and gambled on a “penny stock,” most likely it was traded on the over-the-counter bulletin board exchange (OTCBB), also known as the “pink sheet exchanges.” This was a market dedicated to investments that could not raise enough capital to trade on the prominent exchanges, carried high risk to retail investors and had lower audit standards compared to their larger counterparts at the New York Stock Exchange (NYSE), American Stock Exchange (AMEX), or NASDAQ.

This new ruling opened the door for a spot Bitcoin ETF to graduate from the small OTC exchange to the AMEX or NASDAQ big stage exchange, the designated exchanges for most of the four alphabet-symbolled ETFs.

This also opens the door to institutional investors who may have been restricted to invest their funds in these three major exchanges. Institutional investors are important since they move the most capital (in dollars) within the U.S. equity markets.

Defi Before Tradfi

Prior to the SEC approval, the only way to get direct access to Bitcoin was through unregulated exchanges like Coinbase, Crypto.com and Gemini, also known as a decentralized financial exchange (Defi). Your Bitcoin would be subject to the survival and trust worthiness of that particular Defi exchange. Most exchanges were built on apps where one could link a bank account to transfer cash into a Defi wallet in order to buy BTC and other cryptocurrencies.

Many crypto exchanges came on the rise in 2017 and became more well known during the COVID-19 lockdowns as BTC prices surged over 1000% from March of 2020 to March of 2021. Many of these apps were built on slick advertising and social media hype advertising to stimulus check holding, would-be investors looking to cash in on another get-rich-quick schemes. Many retail investors ended up losing all their funds through the demise of crypto exchanges in 2022 like FTX, Three Arrows Capital, BlockFi and Celsius, which destroyed the confidence of many retail investors. This over-exuberance turned to mistrust and led to a 76% crash in the price of BTC — from $65,000 in November 2021 to $15,000 by November 2022. At the time of this writing BTC/USD is currently trading at $39,950.00, a -16% decline since the January 10 SEC approval.

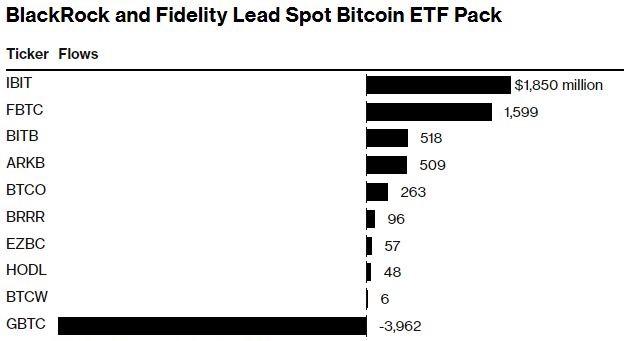

After the SEC approval, many of the leading investment firms had filed their own Bitcoin ETF in anticipation of a near-term SEC approval. This led the way for traditional financial (Tradfi) institutions to participate in this new growth asset class. These firms include fund giants like Blackrock (IBIT), Fidelity (FBTC) and Invesco (BTCO). Other approved fund companies that launched their own Bitcoin ETF were Cathie Wood’s ARK Funds (ARKB), Bitwise (BITB), VanEck funds (HODL), WisdomTree (BTCW), Valkyrie funds (BRRR) and Franklin Templeton (EZBC). After the first week of the Bitcoin ETF launch, Grayscale remained the leader since it has had an eight-year head start with the GBTC Bitcoin Trust. Blackrock led the “newborn nine” with more than 41,000 BTC, followed by Fidelity with 35,216 BTC, Bitwise with 11,500 BTC, and ARK Funds coming in fourth with 11,000 BTC. According to Bloomberg, “BlackRock’s iShares Bitcoin Trust (IBIT) and the Fidelity Wise Origin Bitcoin Fund (FBTC) are leading the field with about $1.9 billion and $1.6 billion of inflows, respectively, according to the latest available data compiled by Bloomberg. That’s roughly a combined 70% of spot Bitcoin ETF inflows so far.”1 Grayscale’s GBTC was the only fund that experienced outflows in its conversion from the Bitcoin Trust to the ETF. Grayscale managed $22 billion in assets, which was reduced by $4 billion as the new ETF issuers nibbled off a portion of Grayscale’s once monopolized market share.

How Do the Investment Firms Own Bitcoin?

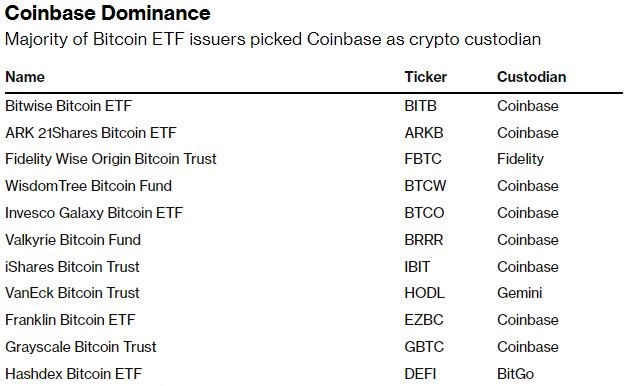

Similar to physical gold, investment firms that offer gold ETFs access the physical assets through a custodian who stores the gold in a secured vault. When investors buy a gold ETF, the ETF represents a fractional percentage of a troy ounce of gold. That gold is allocated to the investment firms and the investor essentially owns a small portion of gold through the fund. The gold custodian stores the physical gold bars within vaults located in Zurich, London and New York. Eight of the 10 investment firms offering the new Bitcoin ETFs use Coinbase as their custodian for the underlying access to Bitcoin.

Why Coinbase? Coinbase remains, excuse the pun, the gold standard exchange for crypto assets and is the world’s largest crypto custodian. The bitcoin is held securely in a cold storage wallet that is a secured offline hard drive and not connected to the internet. Also, Coinbase is one of the only direct exchanges that is publicly traded, which includes scrutinized audited financials by the SEC. Fidelity self-custodies its own Bitcoin holdings through Fidelity Digital Assets; VanEck custodies its BTC holdings through the Gemini exchange, owned by the Winklevoss twins, the brainchildren of Facebook prior to Mark Zuckerberg.

Looking to the Future of the Bitcoin ETF

Bitcoin ETFs now own approximately 4% of Bitcoin that exists in the marketplace, or approximately $31.5 billion of the $787.52 billion market cap. The launch of the 10 ETFs was a wild success within the first week of trading even though the spot price of BTC has moved down off its recent $49,000 BTC-USD high. Similar to many new offerings like this, there were many BTC investors who took profits from the recent run-up in the BTC price.

Nate Geraci, ETF Store president, said, “It’s no small feat for an ETF in any asset class to hit $500 million, let alone a billion in assets under management. To achieve this in a novel asset class less than two weeks after launch is highly impressive.”2

According to a recent Forbes article, “The Bitcoin ETF market is now the second-largest commodities market cap surpassing the Silver ETFs which has a market cap of $11 [billion].”3

Presuming the entire Bitcoin ecosystem was a company listed on the S&P 500, BTC’s $800 billion total market cap would be the sixth-largest firm, just surpassing companies like Berkshire Hathaway (BRK.B) and Meta Platforms (META), according to coinmarketcap.com.

Unless followed by a large decline in market price or a shuttering of a major crypto custodian, Bitcoin is not just for the tinfoil-hat-wearing conspiracy theorists betting on the destruction of the global financial system. It has evolved into a digital store of value backed by the confidence of more than 460 million investors (based on BTC wallet addresses.) Will Bitcoin replace the U.S. dollar as the global currency of the future? Personally, I wouldn’t bet on it, but it is hard to deny that Bitcoin’s viability as a new investable asset class for retail and institutional investors.

An investment in a Bitcoin ETF should be treated like any other high risk-high return investment. It is always important to do your research and understand your overall risk tolerance, investment time horizon and investment objectives before investing. Also consult with your financial professional to understand if this type of asset class is appropriate for your investment allocation.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.