Learn

U.S. Fixed Income Update

By Eric Krueger Synovus, Trust Senior Portfolio Manager

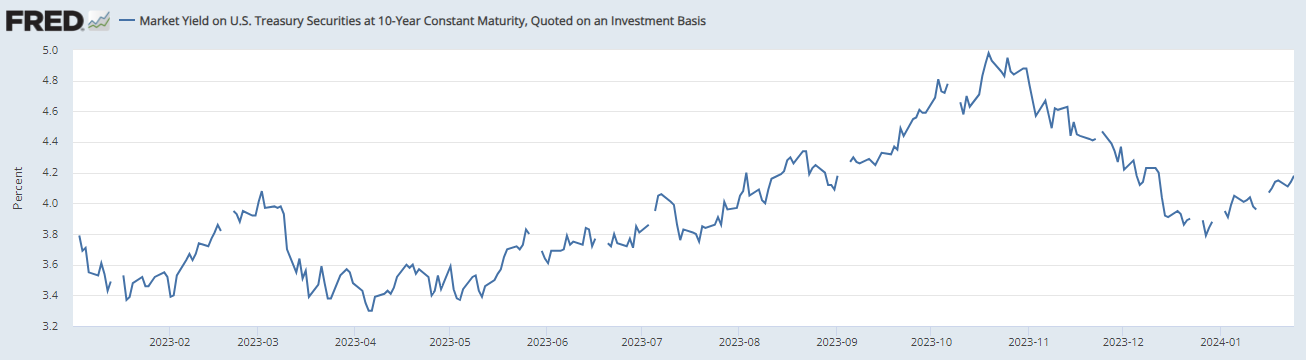

This month's update focuses on the 2024 Fixed Income returns and the current bond market environment in the U.S. In 2023, Treasury yields (10 year) experienced significant volatility, starting and ending around 3.8%. However, credit spreads remained historically low, with attractive overall yields. Municipal bonds, on the other hand, became relatively expensive after substantial returns in November and December. However, there may be better opportunities to enter the municipal bond market later in the quarter. With a downward trend in inflation and the likelihood of the Federal Reserve lowering rates a few times in 2024, conservative fixed income investors can find a favorable opportunity.

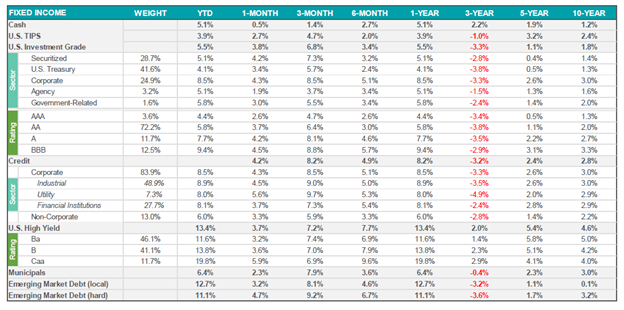

As shown in the chart above, the bulk of fixed income returns occurred in the final three months of 2023. Most high-quality sectors had negative returns up until October, but the strong performance in the fourth quarter helped them achieve relatively "average" returns for the year. The main reason behind the exceptional returns in the final quarter was the Fed Pivot in early November.

Historically, when the Fed completes its hiking cycle, it signals that the peak in interest rates has been reached, allowing investors to "extend duration" by buying longer-dated bonds to secure higher yields for an extended period. This is because the next move by the Fed is likely to be a rate cut.

Fed, Fiscal Policy and Treasuries

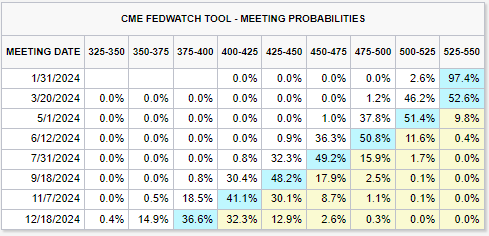

Since the Fed Pivot in November, the market has projected six rate cuts in 2024. In contrast, the Fed's Summary of Economic Projections (SEP) in December only included three projected cuts. Recent statements from Fed speakers suggest a delay in the projected starting date for rate cuts in March. Although inflation has been decreasing, services inflation has remained somewhat higher than expected. The Fed aims to avoid aggressive rate cuts followed by a need to raise rates later, so it is likely to wait a bit longer and proceed more slowly than what is currently priced into rates. Nonetheless, investors should be prepared for rate cuts in the near future. Last June, the Fed projected Core PCE (the Fed's preferred inflation measure) to be 3.9% for Q4/Q4, but it ended at 2.93% with the latest data release.

The market projecting 6 cuts in 2024:

Fiscal policy had a significant impact in 2023 and is expected to continue influencing the market this year, given that it is an election year. Despite the rarity of running a fiscal deficit with low unemployment, the United States Department of the Treasury will likely issue more bills, notes and bonds. The increased supply makes demand a crucial variable to monitor.

Ten-year yields on a wild ride to nowhere in 2023:

Corporates

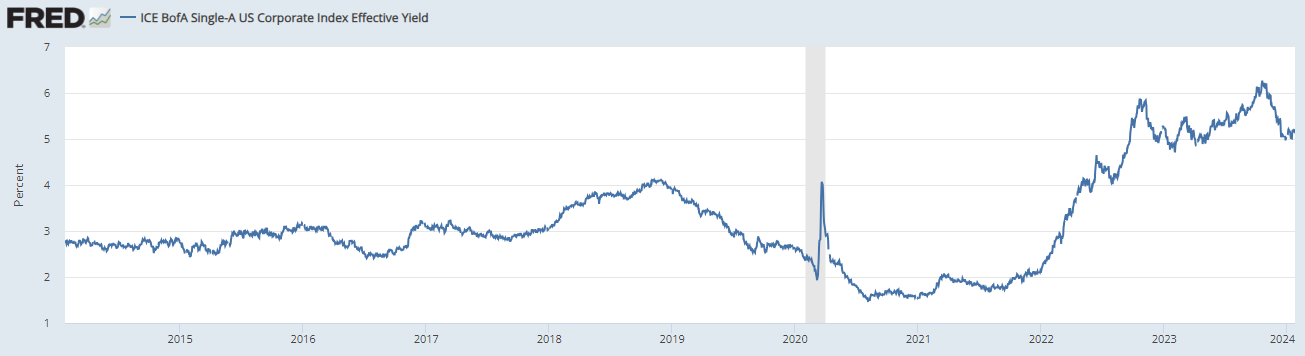

A-rated corporates delivered a 7.7% return last year, with 8.1% of that coming in the final three months. Without that surge, high-grade corporates would have experienced another year of negative returns. Although spreads are historically tight (see second chart down), all-in yields remain attractive compared to the past 10 years.

Corporate yields are historically attractive (below) …

… while Corporate spreads are historically tight (below).

Municipals

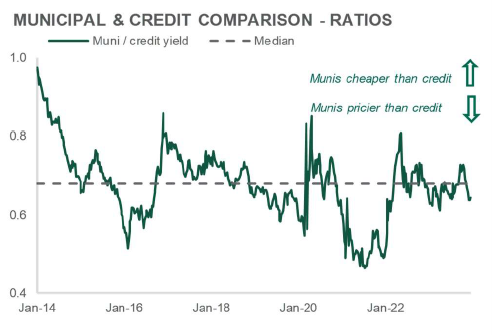

Municipal bonds may not receive much attention as they are typically utilized by individuals in the top tax bracket. However, they can be incredibly useful for generating safe tax-free yield. Nationally, Munis returned 6.4% in 2023, with 7.9% of that return occurring between October and December. The chart below indicates that Munis have become relatively expensive compared to corporates or treasuries after the significant run-up in the fourth quarter. If you already hold Munis, that is great, but it may be wise to invest new funds gradually through dollar-cost averaging.

Munis are slightly expensive after the 4Q run:

Risks

The most significant risk to lower yields is inflation. If inflation proves stickier than projected, the Fed will delay rate cuts. Additionally, conflicts in the Middle East are driving up shipping costs for goods, potentially impacting inflation. Fiscal stimulus is another risk, as the economy has already shown stronger growth and employment. Lastly, with it being an election year and two relatively unpopular candidates, generally speaking, there is a possibility of a third-party candidate entering the race. The 2024 election cycle may bring increased volatility.

Summary

In conclusion, after the huge run in 4Q, fixed income is still attractive overall. The Fed is probably at its “terminal” rate as per their own projections of rate cuts next year. Historically, that is exceptionally good news for bond holders. Given the higher coupons we are seeing this year, high quality bonds are attractive at these levels.

If you have any questions or would like to discuss how these developments may impact your portfolio, please reach out to your Synovus advisor.