Learn

Currency Outlook: Third Quarter 2024

David Grimaldi, Foreign Exchange Sales Consultant

This recent spring has seen a continued dominance of the U.S. dollar as central banks continue to hold them and use for the majority of global transactions. There have been inroads into the BRICS currencies since the Russian invasion of Ukraine, but tighter monetary policy in the U.S. has shifted focus back to a strong dollar. The election of progressive candidate Claudia Sheinbaum in Mexico saw a dramatic shift into dollars away from pesos as the market fears regulation and a negative business atmosphere for the incoming administration.

Last December most economists predicted a summer recession and the Fed Reserve (Fed) cutting rates by March or June. Meanwhile, Canada and Europe were first to cut, with the U.S. looking at September or December, or possibly no cuts at all. Jobs growth, despite its strength, has been negative for U.S. citizens. Global risks are playing a factor in dollar strength as Iranian-backed terrorist group Hezzbollah threatens to expand the Gaza conflict in the Middle East.

In Ukraine, Russian President Vladimir Putin is holding the west responsible for U.S.-supplied missiles that are used in attacks against Russia. The first U.S. presidential debate occurred this past week and could prove to have more of an impact than in past elections. Former President Donald Trump has held narrow leads in overall national polls and has shown gains in critical swing state, according to a number of independent polls.

The national polls are significant since Trump lost the popular vote in 2016 but won the presidency with the most electoral votes; he also lost the popular vote by 6-million plus in 2020. Significant shifts are occurring against the once strong Obama collation, where African Americans are polling for Trump by as much as 25%. Most forecasters say a 15% vote for Trump would be disastrous for President Joe Biden, so 25% is well above the margin for error. Trump has also made significant inroads with young voters and Latin American voters. All this with a possible September sentencing that could see the former president jailed. The felony conviction has had the opposite desired effect, according to polls, as independent voters don’t want to see political opponents jailed like a banana republic — no matter how much they don’t like Trump. The backdrop of both the Democrat and Republican National Conventions could see more heated issues, a continuation of groups commiting violence against Jewish citizens across campuses and cities, including New York and Los Angeles. All these risks have shifted sentiment into safe haven dollar positions, but not entirely committed as volatility remains low.

EUR/USD Sideways to Bearish

The European Central Bank (ECB) cut rates by a quarter point in June, from 4% to 3.75%, with some market expectations of two more decreases this year.

“Despite the progress over recent quarters, domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year,” said the ECB in a statement in the June meeting.

ECB President Christine Lagarde, trying to remain neutral, added, “We are not precommitting to a particular rate path.”

With one rate on the books and few more expected, it would be reasonable to assume the dollar would strengthen significantly. Volatility has remained low in 2024, with the euro stuck in a 400-pip range that really has been back and forth mostly from 1.09 to 1.07. From a technical perspective, the monthly charts are still more dollar bullish while the weekly chart moving averages are running horizontal, which usually means a more sideways direction. The Fed policy will be the main indicator of currency direction, but we might not see a cut until September or December. Meanwhile, several risk factors are out there, including an expanding Middle East war, Ukraine and, of course, the November U.S. presidential election. All these factors should favor dollar buyers into year end until we see what the Fed will do with interest rates.

GBP/USD Sideways to Bearish

Bearish momentum picked up for the pound as inflation hit its $2 target before the U.S. and Europe. The Bank of England kept rates at 5.25% but most expect if inflation remains low there will be an August cut to match the ECB. The economy in the UK has been weaker than the rest of the G7 nations. After two negative quarters of growth, Gross Domestic Product (GDP) rose 0.6% last quarter, and challenges remain for the UK due to hang over Brexit questions. The moderate British Prime Minister Rishi Sunak called an election July 4, which he lost to Labour due to his low favorability. Labour had not won the prime minister position since 2005, but with most of the world moving to more conservative politics, the Tories are in disarray and are polling at historically low levels. Like Trump, Nigel Farage has tried to replace the oldest center right coalition in political history. High inflation, low growth, global wars and illegal immigration have all kept Farage popular. With inflation now at the target 2%, there may be a faster unwind of rates than other G7 nations. Inflation for UK citizens has remained high for services and energy, which is the only reason we have not seen a cut as of yet. Future cuts will lead to downward pressure on the pound, so we will see with the election over.

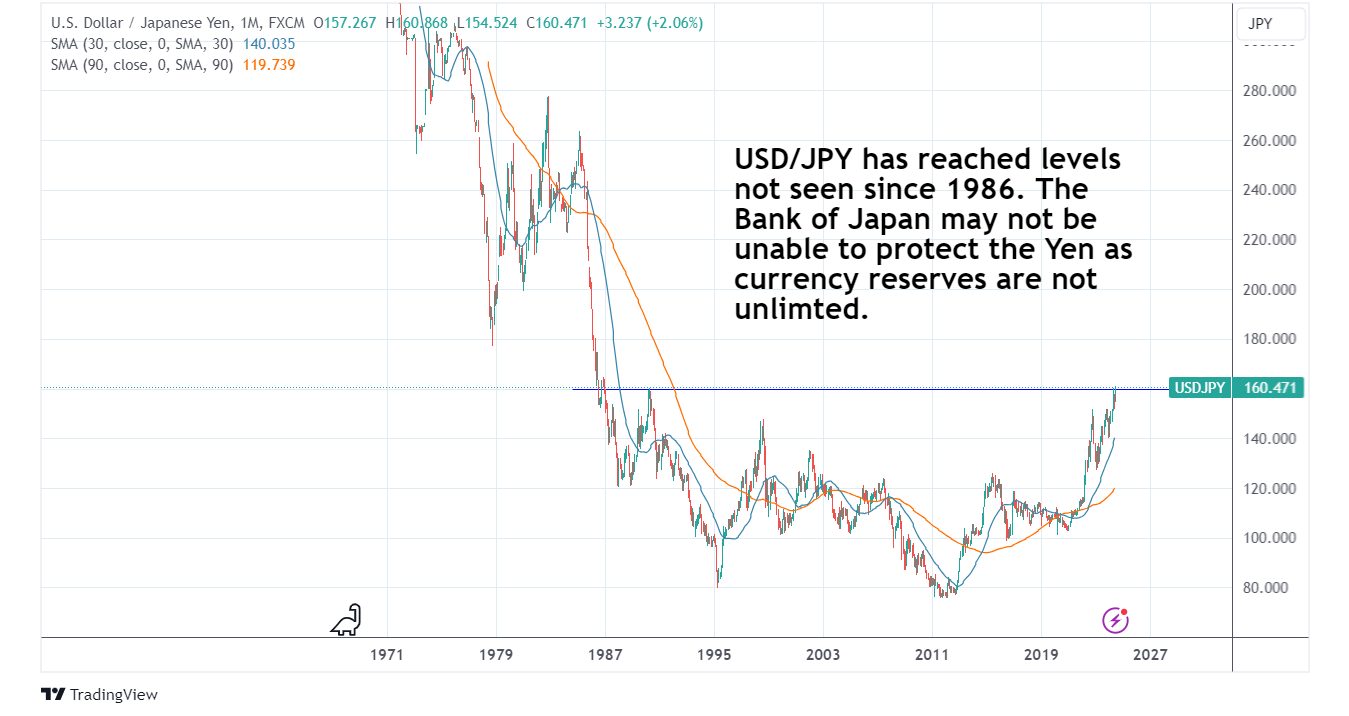

USD/JPY Bullish

The Norinchukin Bank sustained losses of $9.5 billion due to heavy reliance on foreign bond holdings. Like Silicon Valley Bank, it did not pivot as inflation surged, it failed to sell its lower yielding portfolio of bonds, realizing large losses. Further compounding its issues, the bank is primarily agricultural, and the loan values are lower than its commercial banking counterparts. While the dollar has not changed against most G7 currencies, the yen has weakened by 12% in 2024. The Fed has decided to keep rates higher for longer, which has kept bond yields elevated, especially the U.S. 10-year, which is heavily correlated to yen. The Bank of Japan was last rumored to intervene at 160.00, but that level was recently broken with no sign of the central bank. The Bank of Japan is limited by the amount of funds it has to support the yen and the market knows this. Meanwhile, the yen surged to levels not seen since 1986, a year after The Plaza Accord, when the Group of Five Industrialized nations agreed to let the dollar weaken against other currencies. As the Bank of Japan measures next steps in protecting its currency, it is also considering how to execute its quantitative tightening plan. July could present a bigger plan than expected and may even lead to hiked rates in order to stem inflation and strengthen the yen. Bank of Japan Governor Kazuo Ueda told reporters after the central bank meeting that a rate hike next month cannot be ruled out. Japan's balance sheet currently is at $5 trillion, and it could announce steps to reduce its size at the July 30-31 meeting. It is a delicate balance keeping confidence in the bond market and protecting their currency.

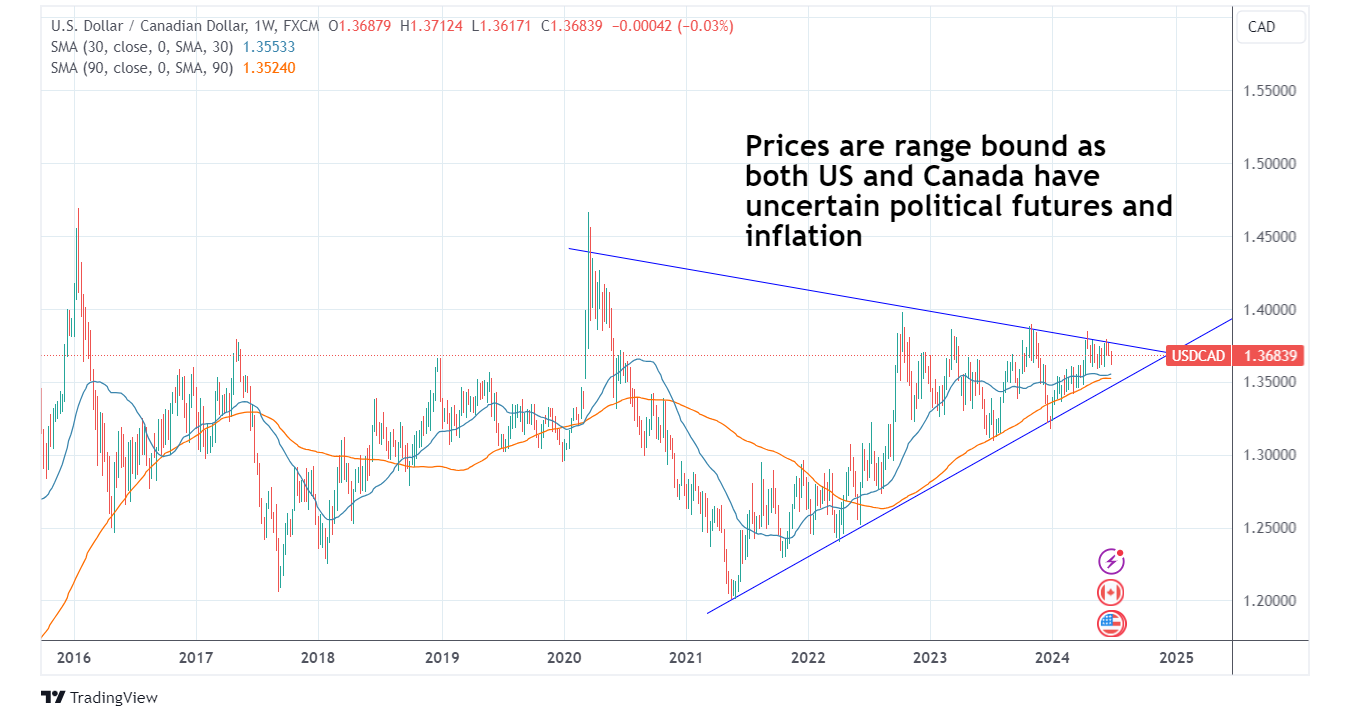

USD/CAD Sideways/Bullish

Canada was the first G7 nation to cut rates, as it lowered rates to 4.75%. Inflation hit a three-year low of 2.7%. Canada’s move has led to Europe and Sweden cutting rates, with the Swiss decreasing to 1.5% in March. Canada’s biggest commodity is oil and price movements have a significant impact on the Canadian dollar. Oil has been mostly range bound under $90 a barrel and has helped moderate inflation since last October. Bank of Canada Governor Tiff Macklem said inflation makes people angry and erodes public trust.

"That's one of the reasons why it's so important to get inflation back down," Macklem told CBC News. "We've taken a bit of a hit, and we're going to have to rebuild that trust." (CBC News)

Macklem is not the only person who has lost trust. Prime Minister Justin Trudeau had a major election defeat as a Liberal MP lost a seat in “Fortress Toronto,” usually a safe haven for its urban constituencies. As a result, Conservative leader Pierre Poilievre has called for a snap general election. Strict COVID-19 policy, Justinflation, housing prices, decline in living standard and the truckers strike have all played a role in Trudeau’s drop in popularity.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.