Learn

Q2 2024 Fixed Income Update

By Eric Krueger, Synovus Trust Senior Portfolio Manager

As we conclude the second quarter of 2024, it's an appropriate time to assess the performance of the fixed income markets and offer an outlook for the rest of the year. The previous quarter was defined by a blend of economic data, central bank actions and geopolitical developments that have influenced bond market dynamics.

Q2 2024 Fixed Income Performance

Treasury Bonds

U.S. Treasury bonds underwent a turbulent quarter, with yields varying in response to changing economic indicators and Federal Reserve announcements. The 10-year Treasury yield began the quarter at 4.33% and is currently concluding near 4.35%. However, these numbers don't fully depict the story as yields peaked at 4.70% and dipped to 4.22%, reflecting persistent concerns about inflation and the Fed's stance on monetary policy.

.png)

Corporate Bonds

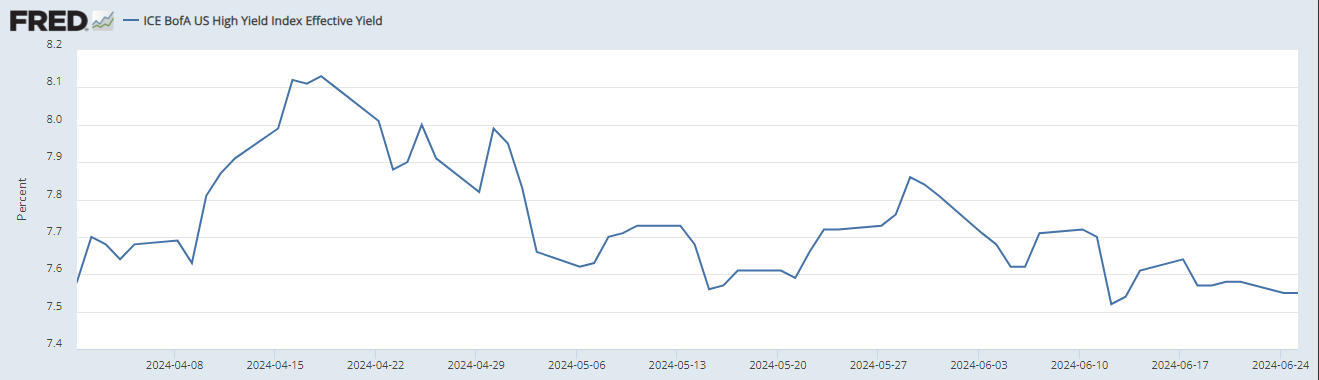

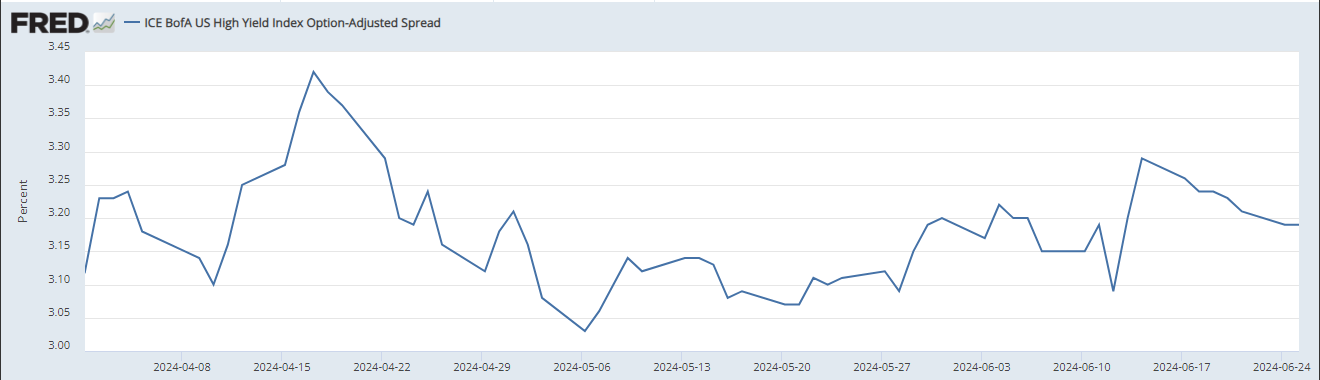

Investment-grade corporate bonds reported modest returns, with the Bloomberg US Corporate Bond Index posting a 0.57% gain for the quarter. Credit spreads slightly tightened as corporate earnings reports generally surpassed expectations, enhancing investor confidence. High-yield bonds outperformed their investment counterparts, returning 1.05%, driven by a robust investor appetite for riskier assets and improved credit fundamentals.

.png)

.png)

Municipal Bonds

Municipal bonds reported a negative quarter, down 0.77%, due to rate volatility offset by favorable supply-demand dynamics and strong credit quality. Tax-exempt income remains attractive to investors in higher tax brackets. Continuous resilience of state and local government finances further supported the municipal market.

Market Drivers and Themes

Inflation and Central Bank Policy

Inflation continues to be a significant concern for fixed income investors. Despite headline inflation showing signs of moderation, core inflation measures persistently remain high, leading central banks to maintain caution. The Federal Reserve indicated its readiness to keep rates steady until it has greater confidence in declining inflation.

Economic Growth

Economic growth indicators present a mixed picture, with some sectors demonstrating strength while others show signs of slowing. Robust labor markets bolster consumer spending, whereas the manufacturing and housing sectors exhibit weakness. This disparity creates uncertainty about future economic growth and interest rate trajectories.

Geopolitical Risks

Geopolitical tensions, especially in Eastern Europe and the Middle East, have introduced an additional layer of uncertainty to global markets. These developments could potentially disrupt economic activities and investor sentiment, thus impacting bond markets.

Fixed Income Outlook for H2 2024

As we look forward to the second half of 2024, we anticipate several key themes to shape the fixed income landscape, including two key themes:

Monetary Policy Shifts

The market reacts to every new data point, particularly inflation and employment data releases, given the Fed’s “data dependency.” While the Fed may hold out longer than the market anticipates, they aim to ensure that inflation is in check. They are wary of initiating rate cuts prematurely and having to restart rate hikes if inflation unexpectedly surges.Election Cycle

The election cycle for investors has commenced earlier than any recent election due to the recent debate. The earliest debate previously was in September, making this an exceptionally early start. Betting markets have increased Trump's chances of winning to better than 60% and Biden's to less than 40% following the debate (source: PredicIt). Given the candidates' differing approaches to fiscal policy, immigration, and taxes, the bond market is likely to experience increased volatility through the election.

Conclusion

As we navigate the intricacies of the fixed income markets in the upcoming months, our focus will remain on identifying opportunities that balance risk and return. Historically, the likely end of rate hikes has been an opportune time to invest in bonds since it's near the peak in rates. We will persistently monitor economic indicators, central bank actions and geopolitical developments to adjust our strategies accordingly. Your diversified fixed income portfolio is designed to weather various market conditions, and we remain dedicated to achieving your long-term investment objectives. If you have any questions, please reach out. If you have any questions or would like to discuss how these developments may impact your portfolio, please reach out to your Synovus advisor.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.