Learn

November Market Update: I Was Way Off!

By Chris Brown, CIMA®, CRPC™

Vice President — Investments

The broad markets, specifically the S&P 500, have provided surprising returns over the past 10 months. The S&P 500’s “Magnificent 7” technology stocks have continued to lead the charge from 2023, as the artificial intelligence (AI) craze maintained its upward trajectory. It seemed like January was just a few months ago, and in my January Market Update I stated, “If the U.S. economy maintains a continuation of stable labor markets, a resilient consumer coupled with lower inflation and a softer future interest rate environment, then the S&P could receive a boost, trading in the range of 20 to 21 in forward P/E. A bullish outlook estimate of $247 EPS multiplied by a 21 P/E provides a 2024 S&P 500 outlook of 5,187. This would be a 9.43% gain for the calendar year in 2024 from current S&P levels.”

Some responses to my shared article sounded something like, “This is way too optimistic”, “There is no way the markets can sustain this,” or my favorite, “This is going to age poorly, but we’ll see.” Well, the last part was right; I was way off the mark because the market blew right past my 5,187 or 9.43% gain estimate. Let’s take a look at how wrong I was.

The S&P 500 through October 25 was up 21.77%, at 5,808, which is just over double the return of my January estimate. The markets have been so resilient this year that the 5,187 estimate that I provided in January was eclipsed in March. The only significance of this estimated S&P return is that it serves as our low point of the market for the second half of the year, thus far. This occurred when the Yen carry trade exploded overnight, resulting in a 7% correction on August 5. Since the August low, the S&P 500 has rallied 12.81% from the time of this writing.

How did this happen? There has been escalating violence and war in the Middle East; protests on multiple college campuses over the Israel-Hamas conflict; Red Lobster filing bankruptcy because it gave away too much free shrimp; criminal proceedings of a presidential candidate; two assassination attempts of a presidential candidate; an incumbent presidential candidate dropping out of an election, which ushered in a new presidential candidate; and, finally, a Japanese Yen trade that created a 7% flash crash in the markets. On and on and on but the markets still pushed forward. How? As a start, two main contributors would be the S&P 500 corporate earnings and a continued strength in the U.S. consumer.

Earnings

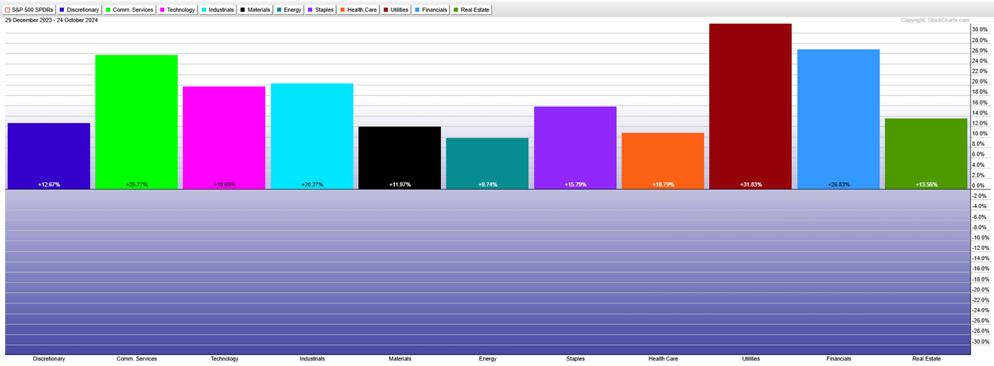

Corporate earnings have been healthy given the macro geopolitical instability and our own domestic political uncertainties in another election year. Compared to the past two years of high inflation and recession whispers, earnings have steadily climbed in 2024. All 11 of the S&P sectors were up 9% or higher year to date.

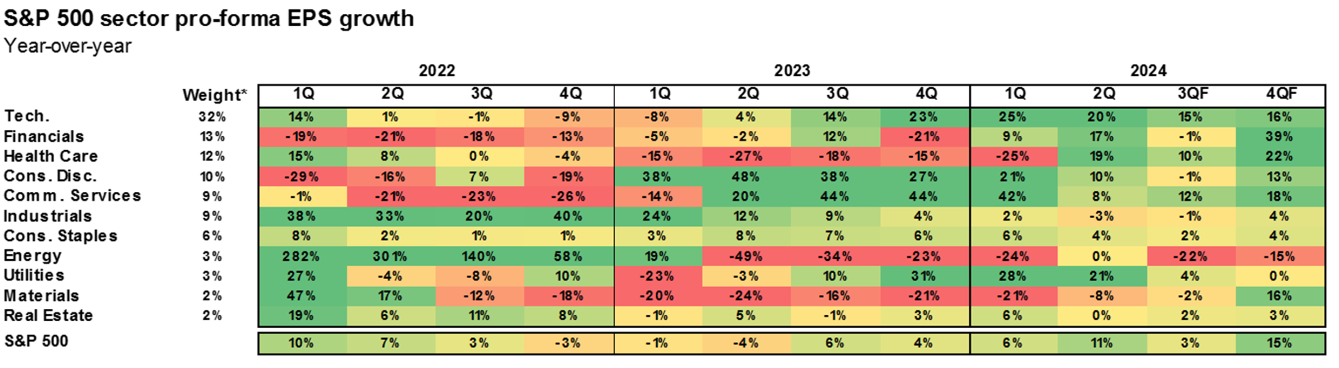

The JP Morgan Guide to the Markets charts below illustrates the earnings growth of each S&P 500 sector over the past three years. You can see from left to right how the continued improvement of the quarterly earning growth appears healthier Q4 of 2024.

The U.S. Consumer Rules the Roost

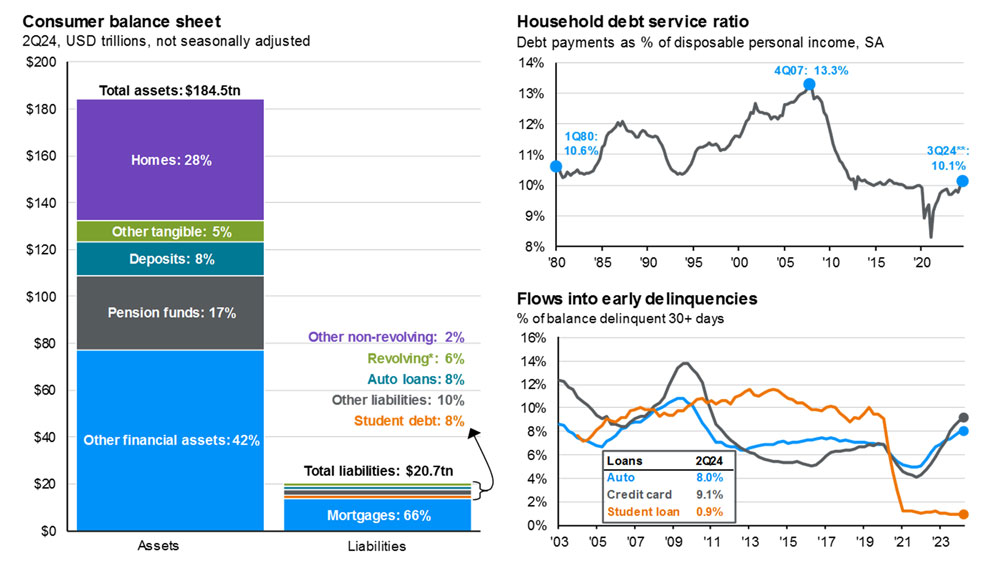

As I have stated in previous writings, if you want to know how the U.S. economy is doing just follow the U.S. consumer. The growth of the U.S. economy or Gross Domestic Product (GDP) is driven by the two-third’s piece of the pie, which makes up consumer spending. Even though most of the COVID stimulus spending has abated over the past few years, asset prices of homes, stock and bond investments, as well as business valuations, has seen an overall increase over the past years.

According to a Reuters article published on September 12, “U.S. household wealth rose last quarter to $163.8 trillion, a fresh record, driven by gains in real estate values as well as a rise in the stock market, according to Federal Reserve data in October.

The increase in the net worth of households and nonprofits, which stood at $161 trillion at the end of the first quarter, was driven largely by a $1.8 trillion increase in the value of real estate holdings and a $700 billion gain in the value of equity holdings.”1 If you own a home and you have some type of company retirement plan, you have benefited from your investments. If you were a conservative holder of cash alternatives such as CDs, T-Bills, or fixed annuity products, you have benefited from the higher interest income of the past couple years. Then why does it not feel like it? Simple, U.S. consumers hate inflation. The chart below provides a bit of insight on the U.S. consumer balance sheet, household debt service ratio, simply meaning: what’s the percentage of net income dedicated to debt payments.

The main points I wanted to drive home is how we feel about the markets and the economy is one thing, but the data of how the consumer and economic performance provides a glimpse of where we need to look as the weight-of-the-evidence approach. Market vibes will not lead you to financial prosperity. Market skepticism, scrolling through social media and doomsday predictions through YouTube and news subscriptions only attract eyeballs and create further confirmation biases on why you should not invest in the markets. Let’s face it: bad news sells. Bad news and scandal receives front-page attention in bold print while good news is skipped over or ends up on page six in the smaller font.

No one can predict the future. Look how wrong I was from my January 2024 estimates! All we can do is assess the path in front of us as we navigate through smooth seas as well as choppy waters of the markets and life in general. The best way to reach your financial targets is to develop a flexible comprehensive plan that allows you to maintain focus on your financial destination. Working with a financial professional to define your financial objectives, risk tolerance and time horizon may help you create a fortified plan in the face of economic turbulence.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.

- “U.S. household wealth rises in Q2 to record $163.8 trillion,” Reuters, published September 12, 2024. Accessed October 30, 2024. https://www.reuters.com/markets/us/us-household-wealth-hits-record-1638-trln-real-estate-gains-2024-09-12/ Back