Learn

The Personal Trust Corner: A J.D.’s Perspective

A Deep Dive into ILIT

By Amy Piedmont, J.D., LLM, Vice President, Sr. Trust Relationship Manager and

Katherine “Kate” Gambill, J.D., Vice President, Sr. Trust Relationship Manager

In our series, “The Personal Trust Corner: A J.D.’s Perspective,” we aim to spotlight one planning strategy each month in response to the ever-changing Estate Tax Laws. This month, we turn the spotlight on the Irrevocable Life Insurance Trust (ILIT), a remarkable tool that offers numerous benefits for those with substantial life insurance policies. For high-net-worth couples and individuals, estate planning often involves intricate strategies designed to safeguard wealth and ensure a solid financial legacy. These strategies can be employed individually or in combination.

Navigating the Maze of Estate and Gift Tax Exemption

Navigating the complex universe of the unified lifetime gift and estate tax exemption can feel like journeying through a labyrinth. Our mission at Personal Trust is to provide a guiding light to our clients as they traverse these often-treacherous waters.

A significant area of focus, at present, is the exemption for 2024, currently at $13.61 million. Portability, a powerful tool, amplifies this exemption, allowing married couples to share their unused exemption with one another, often equating to $27.22 million in estate tax exemption.

However, estates exceeding this threshold are subject to a hefty 40% tax on the surplus, often seen as “double” taxation as income tax was already paid on earned income during life.

The landscape of estate tax, though, is prone to seismic shifts. Current laws are set to “sunset” at the end of December 2025. Unless Congress intervenes, the estate tax exemption will revert to a $5 million dollar exemption (indexed for inflation) in 2026, predicted to equate to approximately $7 million dollars in exemption.

The Gift Tax Exclusion and Annual Giving

When it comes to annual gifts, the burden of taxation falls on the donors rather than the recipients. However, the present annual gift tax exclusion of $18,000 (2024) offers some relief. This allows individuals to gift up to $18,000 annually tax-free. In the case of married couples, the donor may give each spouse $18,000, totaling $36,000, without incurring taxes or reducing your overall remaining lifetime gifting/ estate tax exemption.

Estate Tax Planning Highlight: The Irrevocable Life Insurance Trust

An ILIT is particularly beneficial for those looking to mitigate potential estate tax liability and shield their wealth from potential creditor claims. This becomes especially pertinent if there's an anticipation of considerable asset appreciation over time, or a projected decrease in the estate tax exemption in the future. The proceeds from life insurance, accessible through an ILIT, can serve as a critical asset in one’s estate plan, offering beneficiaries a source of funds to support their needs, cover debts and settle estate taxes.

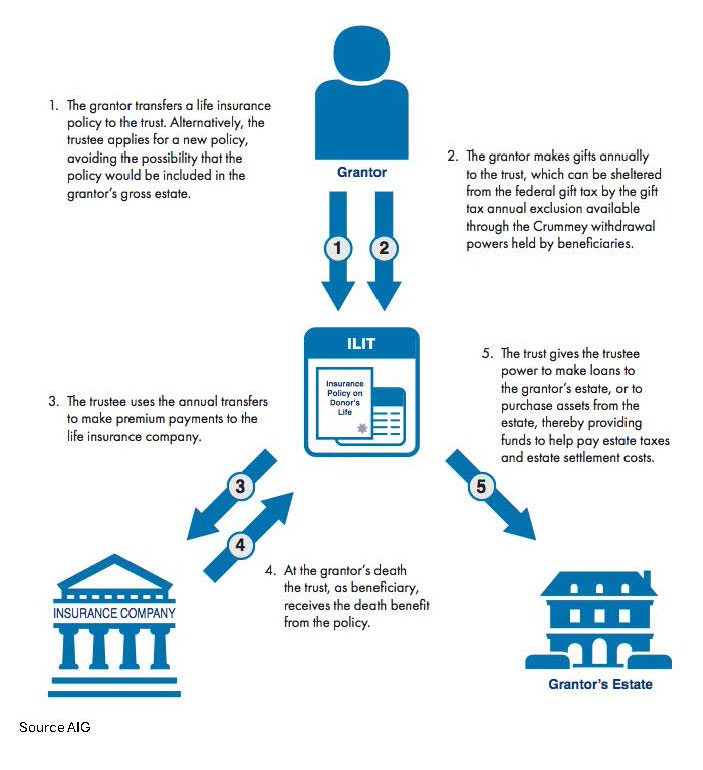

The Mechanics of an ILIT

An ILIT is a perfect fit for individuals concerned about estate tax liability, liquidity for estate taxes, wealth transfer, asset protection and control over policy proceeds. If an individual's estate is sizeable and potentially subject to estate tax, an ILIT can exclude the death benefit of the life insurance policy from the estate, thereby reducing possible estate tax liability. Typically, when an individual owns a life insurance policy on their own life, the death benefit proceeds will be included in their taxable estate. When an ILIT is the owner of a life insurance policy, the death benefit proceeds are excluded from the insured’s overall estate tax.

ILITs present a robust option for business owners and high net worth individuals by providing liquidity to pay estate taxes and other expenses upon the grantor's death, without needing to liquidate other assets. They are a powerful tool for transferring wealth to beneficiaries outside of the grantor's estate, especially if the grantor has exhausted their lifetime gift and estate tax exemption. Assets housed within an ILIT are generally shielded from the creditors of the grantor and the beneficiaries.

The grantor can dictate the ILIT’s terms, allowing them to control how, when and to whom the policy proceeds are distributed posthumously.

The Criticality of Careful Planning

While the benefits of an ILIT are considerable, it is crucial to note that once established and funded, an ILIT cannot be changed or revoked. Therefore, the grantor must be sure about their decisions concerning the trust and the life insurance policy. For the estate tax exclusion to be effective, the covered individual must live at least three years after transferring an existing policy into an ILIT, unless the policy was sold to the ILIT at fair market value.

The grantor cannot access the cash value of the life insurance policy once it's owned by the ILIT. Contributions to the ILIT to cover life insurance premiums may incur gift tax, although this can often be mitigated using "Crummey Letters" sent to beneficiaries to notify them of their right to withdraw the gifted value and utilizing the annual gift tax exemption of the Grantor. ILIT administration, including sending out Crummey notices and filing tax returns, can be complex and costly, underlining the importance of careful planning.

In the world of estate and gift tax exemption, challenges and opportunities abound. Tools like the ILIT can be instrumental in effective estate planning, but they demand careful consideration and strategic planning. At Personal Trust, our commitment is to guide you through this intricate landscape, and hoping to find the best possible outcomes.

Please reach out to our Senior Trust Relationship Managers: Amy Piedmont, J.D., LLM, Vice President, in Pensacola, Florida and Katherine Gambill, J.D., Vice President, in Atlanta with any questions or to start a conversation regarding estate planning. We welcome the opportunity to introduce you to how Synovus Trust Company can serve your needs.

Important disclosure information

Asset allocation and diversifications do not ensure against loss. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information.