Stop, drop and call. Synovus will NEVER call, email or text you asking for personal information, login credentials or computer access. If you receive a request claiming to be from us, don’t respond. Call us directly at 888-SYNOVUS (888-796-6887) to report the incident.

Manage and Resolve

Fraud can happen to anyone, even the most vigilant and informed individuals. Scammers are skilled at exploiting fear, urgency and confusion, often preying on your stress or instinct to be polite.

What to do if you’ve been affected by fraud

You can either visit your local branch or call us anytime at 888-796-6887 to report fraudulent or suspicious activity.

When our virtual assistant Jamie picks up, say “Fraud on my account,” and explain the issue:

- “Lost or stolen debit card”

- “Lost or stolen checks or checkbook”

If you’ve noticed fraudulent transactions on your account, you can say:

- “Fraudulent activity”

- “Dispute a transaction”

Or if you aren’t sure, you can say:

- “Suspicious activity on my account”

- “Identity theft”

What to do about identity theft

Looking for fraud and risk management for your organization? Visit our Commerical Insights Center.

Management and resolution articles

Be Vigilant Against Fraud and Tactics

November 18, 2025 | 2 min read

Synovus has taken measures to educate customers about the perils of those trying to gain access to your data and, likely, your accounts.

7 Ways to Protect Yourself From Identity Theft

March 29, 2024 | 3 min read

Identity theft is far too common. Here’s how to protect yourself — and what to do if you’re a victim of this fraud.

Learn and Prevent

Emerging technologies and fraud tactics are being used to steal identities and take over finances; some are new, while others are more sophisticated approaches to common practices. The good news is, you can prevent these scams from happening to you.

Spot fraud in everyday communication

Tailored Solutions

Look out for callers claiming to represent trusted institutions asking for personal information or demanding immediate payment. Scammers often use high-pressure tactics or spoofed caller IDs to appear legitimate.

Social media and online ads

Be cautious of offers that seem too good to be true, like “free giveaways” or investment schemes. Scammers often create fake profiles, pages or ads that mimic legitimate businesses to steal information or money.

Email or texts

Beware of unsolicited messages asking you to click links or download attachments. Fraudsters often disguise themselves as trusted companies or use alarming language to trick you into acting quickly.

Websites and apps

Always verify the legitimacy of websites or apps before entering personal information or downloading them. Look for secure website URLs that begin with “https” and avoid apps that request excessive permissions or lack clear developer information.

Is it Synovus?

No reputable financial institution — including Synovus — will ever call, email or text you to ask for personal information. To help you spot the difference, here’s what scammers often do and what we’ll never do.

Scammers often:

- Tell you your money isn’t safe or your account’s at risk

- Create elaborate stories about why you need to do something, often posing as an authority figure to earn your trust

- Pressure you, saying you could get in trouble or arrested

- Claim you need to move money due to a fraud investigation

- Encourage you to lie to bank staff or family and friends about your payment

- Direct you to make a payment, telling you which payment method to choose

- Ask you to buy gift cards to pay them

Synovus will never:

- Ask for your PIN or online banking information

- Tell you your money isn’t safe or your account’s at risk

- Ask you to transfer money to protect it from fraud

- Ask for your help with an investigation

- Text you a link to make a payment

- Tell you to lie to anyone about a payment or withdrawal

- Send a courier to pick something up from you

- Ask for remote access to your device

- Share your personal details to convince you it’s us

- Discourage you from verifying any communication you receive from us

Education and prevention articles

What Are Common Types of Credit Card Fraud?

November 17, 2025 | 4 min read

Learn more about the most common types of credit card fraud and what steps you can take to protect yourself from becoming a fraud victim.

Shhh! Don’t Tell Anyone That Access Code!

November 18, 2025 | 4 min read

One-time access codes are for account owners’ eyes only, but scammers are tricking victims into sharing them.

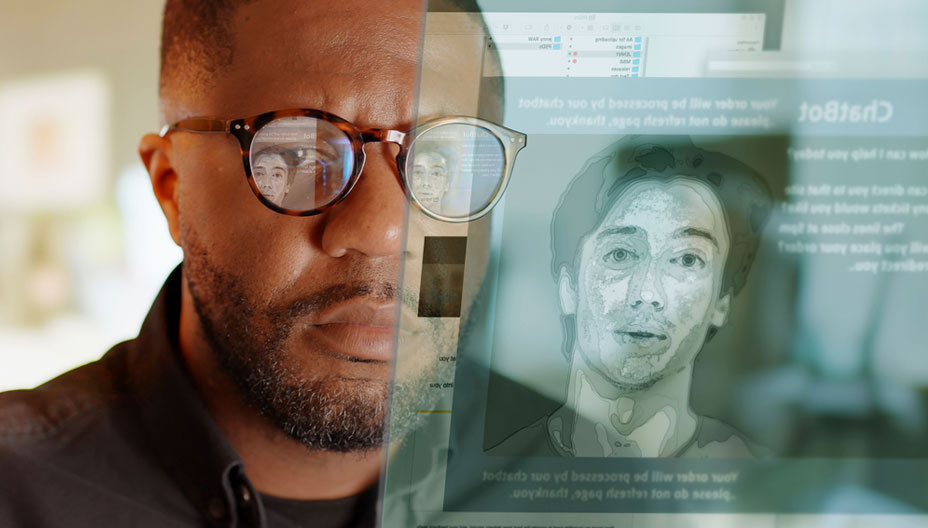

How Criminals Can Use ChatGPT for More Effective Phishing

April 24, 2025 | 5 min read

ChatGPT and other chatbots can help make phishing fraud harder to detect. Here’s how to detect the next generation of phishing messages.

How Deepfake Scams Use Familiar Faces to Scam Victims

January 28, 2025 | 5 min read

You’d never trust a stranger asking for money online. But what about a loved one in distress? Deepfakes make it hard to tell the difference.

Top End-of-Year Frauds to Avoid

November 7, 2025 | 5 min read

Ideally, the holiday season is full of joy, but thieves also go into overdrive as grinches. Learn more about common holiday scams and how to avoid them.