Learn

Fed and Interest Rate Update

Eric Krueger, Synovus Trust Senior Portfolio Manager

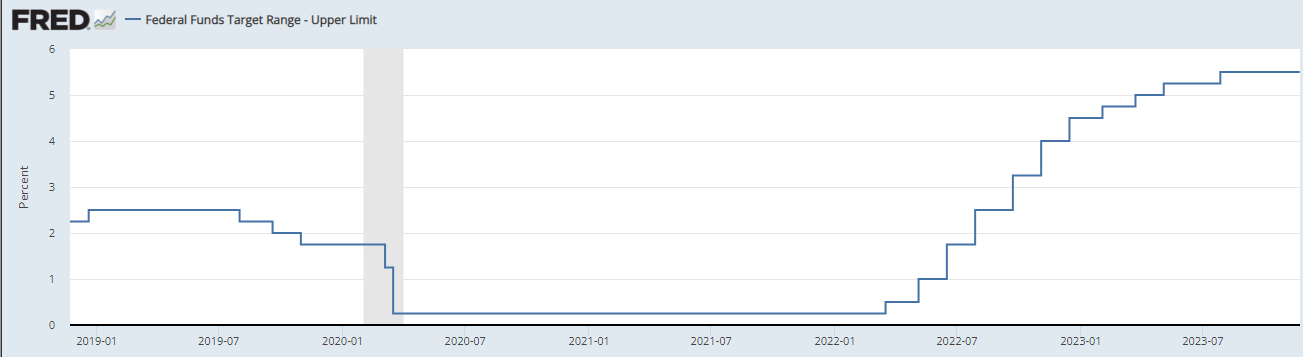

This month we will once again delve into the recent Federal Reserve decision and its implications for market interest rates. On November 1, the Fed opted to maintain rates at the same level for the second consecutive time. The market now anticipates that rates will remain stable until May 2024, at which point a 1.00% decrease in rates is expected during the second half of 2024.

Fed Update

During the Federal Open Market Committee (FOMC) meeting, the committee decided to hold rates steady on November 1 for several reasons, including:

- Economic activity expanded strongly in the third quarter

- Job gains, although slightly moderated, remain robust and unemployment remains historically low

- Inflation, while descending, remains uncomfortably high

The FOMC meeting was largely uneventful, with rates being held steady. Many on Wall Street predict that the rate hiking cycle is now finished. Employment and inflation are the two primary factors driving Fed policy. As mentioned earlier, employment continues to be strong, with the economy offering 3 million more jobs than there are unemployed individuals (9.55 million job openings versus 6.51 million unemployed). Inflation has also continued its downward trajectory, with risk-free rates following suit.

Fed Rate Impact on Market Interest Rates

The Federal Reserve's actions have a ripple effect on various segments of the financial markets, including interest rates. Here are how the Fed's controlled rates may impact market rates in different areas:

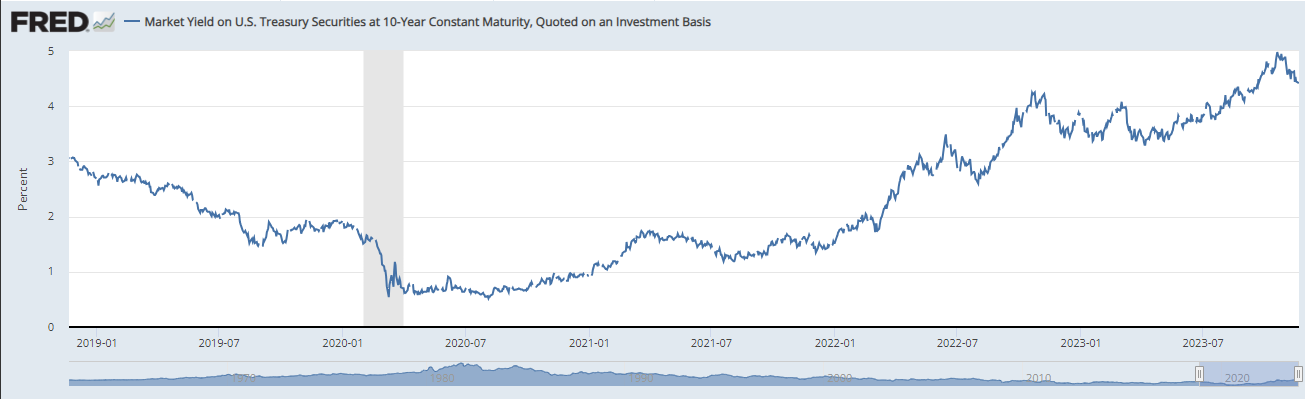

- Treasury Yields: Treasury yields typically peak when the market believes that the Fed has completed its hiking cycle. Yields on the 10-year Treasury note have significantly decreased since the October CPI reading, and the November 14 report further confirmed this slowdown.

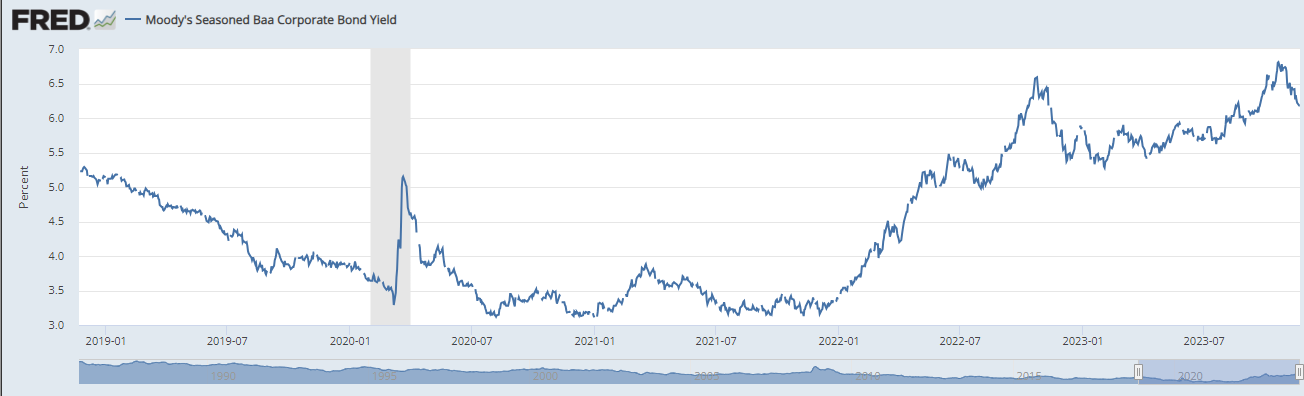

Source: https://fred.stlouisfed.org/series/DGS10 - Corporate Bonds: High-grade corporate spreads have returned to their lowest levels for the year, indicating little concern about corporations' ability to repay their debts. Despite the lower risk-free yields in recent weeks, all-in corporate yields are back at their September levels but still higher than those observed in January.

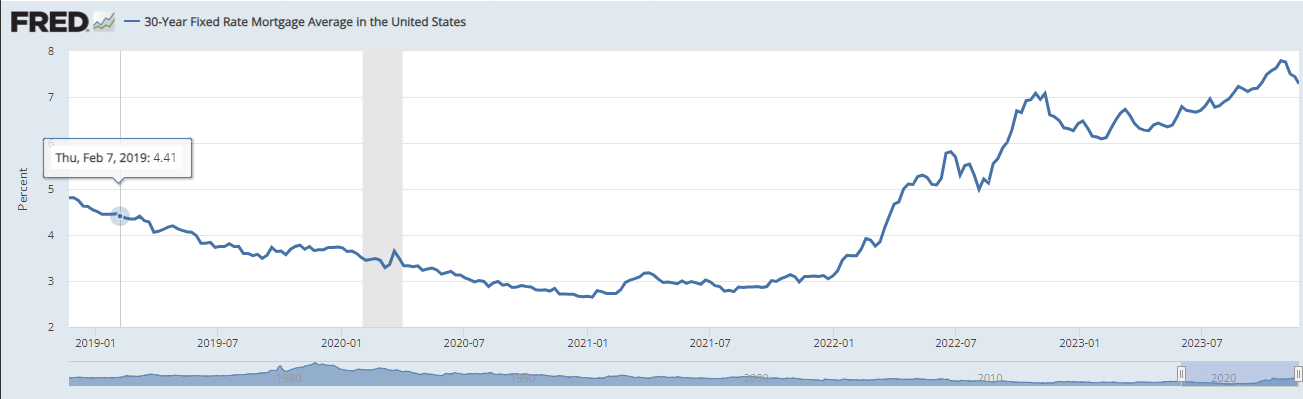

Source: https://fred.stlouisfed.org/series/DBAA - Mortgage Rates: Since mortgage rates are closely tied to long-term Treasury yields, they have also decreased over the past month. Rates peaked at 7.79% in late October but have since fallen by 50 basis points to an average of 7.29% at the time of writing.

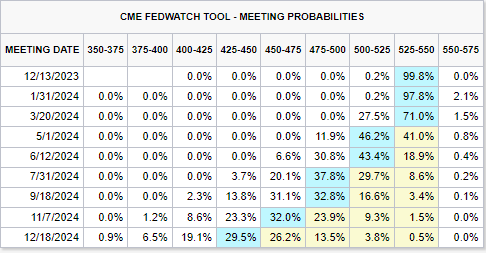

Source: https://fred.stlouisfed.org/series/MORTGAGE30US - Market Fed Funds Forecast: Over the past 30 years, the average time from the last Fed rate hike to the first rate cut has been around nine months. Given the last hike in July, this would suggest the first rate cut around April. The Fed holds meetings approximately every six weeks (eight per year). The market, in line with expectations, anticipates the first cut at the May 1 meeting.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

In conclusion, the Federal Reserve’s recent decisions underscores its commitment to taming inflation, while respecting the long and variable lags those decisions have on economic activity. The good news is that the Fed is likely close to its “terminal” rate as per their own projections of rate cuts next year.

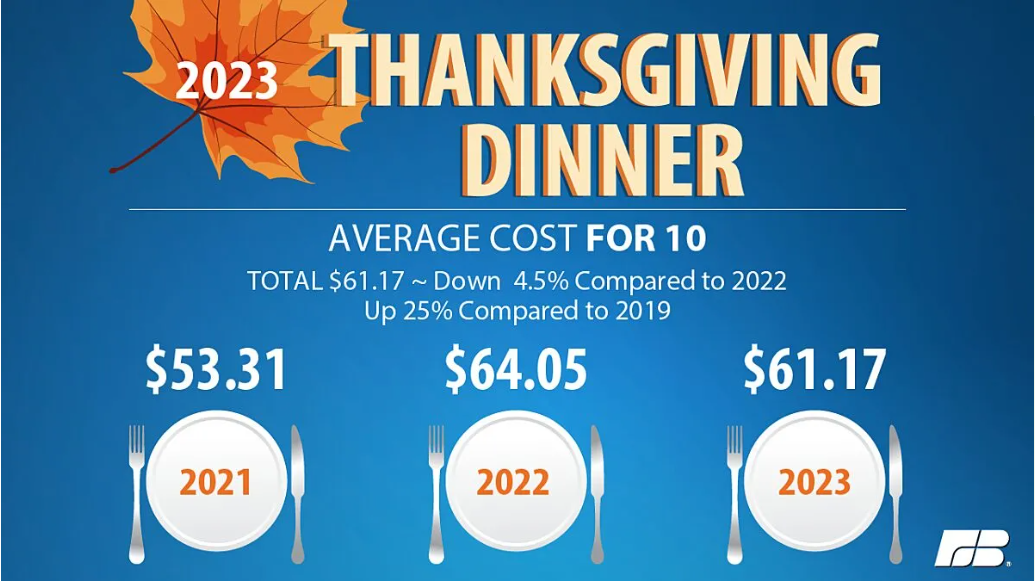

Inflation will continue to dictate the Fed's outlook on how long to maintain rates at the current level. The good news is that inflation is currently making the Fed's job somewhat easier, but prices are still high compared to a few years ago, similar to the average cost of Thanksgiving Dinner, which is...

If you have any questions or would like to discuss how these developments may impact your portfolio, please reach out to your Synovus advisor.

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.