Learn

Tech Corner: Has the Semiconductor Market Finally Bottomed?

By Daniel Morgan, Synovus Trust Senior Portfolio Manager

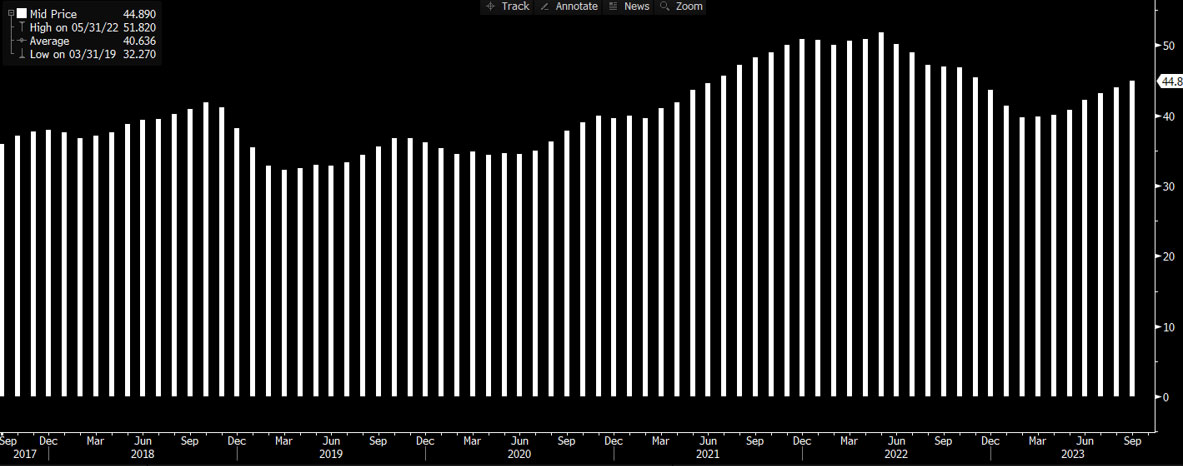

The Semiconductor Industry Association (SIA) recently announced global semiconductor sales for the month of September 2023 increased 1.9% compared to August 2023 and fell 4.5% compared to September 2022. Worldwide semiconductor sales totaled $134.7 billion during the third quarter of 2023, an increase of 6.3% compared to the second quarter of 2023. Global semiconductor sales increased on a month-to-month basis for the seventh consecutive time in September, reinforcing the positive momentum the chip market has experienced during the middle part of this year. The long-term outlook for semiconductor demand remains strong, with chips enabling countless products the world depends on and giving rise to new, transformative technologies of the future. Regionally, month-to-month sales increased in Asia Pacific/All Other (3.4%); Europe (3.0%); the Americas (2.4%); and China (0.5%). Yet it decreased slightly in Japan (-0.2%). Year-to-year sales increased in Europe (6.7%) but decreased in the Americas (-2.0%), Japan (-3.6%), Asia Pacific/All Other (-5.6%) and China (-9.4%).

Semiconductor Industry Association (SIA) Monthly Revenue

The chip industry over the course of the past seven quarters has experienced quarter-over-quarter (QoQ) growth after pulling out of a valley in the February of 2023. Different sectors within the chip space — cloud/datacenter/artificial intelligence (AI), telco/enterprise infrastructure, PC/laptops, smartphones and automotive/industrial — are experiencing different paces of recovery. The PC, tablet and smartphone semiconductor markets are starting to improve, but slowly. These combined markets will represent 31% of semiconductor revenue in 2023 and total $167.6 billion. These high-volume markets have saturated and become replacement markets devoid of compelling technology innovation. In contrast, both the automotive and industrial, military/civil aerospace semiconductor markets will achieve some growth. For example, the automotive semiconductor market is forecast to grow 13.8%, reaching $76.9 billion in 2023.

With the SOX (Philadelphia Stock Exchange Semiconductor Index) up 37% year-to-date (YTD), has broad-based semiconductor stocks simply gotten ahead of themselves given the likelihood of an extended inventory depletion cycle. Many analog and MCU suppliers have posted strong returns in 2023 despite the sluggish environment, likely due to the “less bad” characteristics of the current cycle and prospects for a 2024 rebound. There is a potential for the inventory headwind to last into early 2024 and sub-seasonal demand to extend beyond the calendar year. So, while investors are buying into the “less bad” down cycle, caution investors that the broad-based supply chain inventory depletion is in the early stages, and there’s a good chance that the industry enters 2024 with some level of supply chain inventory overhang acting as a headwind to a cyclical rebound.

So, what do all these projections mean? Let’s take a look at recent 3Q23 financial results of a sample of bellwether semiconductor companies that operate in the faster chip industry growth segments to gauge overall industry health:

Datacenter/Cloud/AI/Deep Learning — According to Bluefin Research, for 2023, aggregate Server builds are expected to be down, -6% YoY. Looking into 2024, Server build growth should be in the 2% to 6% range. Anticipate hyperscale capex to be increased to accommodate higher general purpose Server builds, also expect AI Servers to capture the lion’s share of the overall capex upside. It appears that generative AI spend in the datacenter cloud space is taking priority over the transition to newer, more expensive platforms, as general Capex in cloud slows. How is this growth even possible (in the context of 2023 cloud budgets that appear up only slightly?) Cloud customers are rapidly shifting budgets toward AI, so this strength is coming at the expense of traditional servers and other legacy areas. There are obviously going to be areas where new servers are needed but think that customers are extending the lives of server CPUs, delaying transition to newer, more expensive Intel-based Sapphire Rapids and Genoa platforms to make room for mission critical investments in AI. With the global AI chip market valued at $11.2 billion in 2021 and projected to reach $263.6 billion by 2031, growing at a compound annual growth rate (CAGR) of 37.1%, (based on a research report produced by Allied Market Research) the opportunity is vast!

Intel reported better than expected results in the 3Q23, and guided for higher-than-expected fourth quarter revenue of $14.6 billion and $15.6 billion, versus estimates of $14.31 billion in sales. Intel’s Data Center and AI division, which offers server chips, saw sales decline 10% QoQ to $3.8 billion. However, this is a smaller decline than seen in previous quarters.

Intel has a slew of AI chips that it plans to release in the 2024-2025 timeframe, which includes:

1. Habana Gaudi3: Gaudi is one of many Intel AI chips that the company has made available to customers in different markets. Gaudi3 is targeted at deep learning in enterprise computing. Gaudi is designed from the ground up to accelerate DL training workloads. Its heterogeneous architecture comprises a cluster of fully programmable Tensor Processing Cores (TPC). The Guadi AI chip will compete directly against NVIDIA’s HopperH100 and forthcoming Blackwell B100 datacenter GPUs, as well as AMD's Instinct MI300X GPUs.

2. Falcon Shores: Intel's datacenter GPU with anticipated launch in 2025-timeframe. Intel originally planned for its Falcon Shores chips to have both GPU and CPU cores under the hood, creating the company's first “XPU” for high-performance computing. However, its surprise announcement that it would pivot to a GPU-only design leaves Intel unable to compete with AMD's Instinct MI300 and Nvidia's Grace Hopper processors that both feature a blended CPU+GPU design.

Advanced Micro Devices (AMD) reported better-than-expected earnings and revenues on the recent 3Q23. But it was its guidance for AI chip sales in FY2024 that excited investors! AMD is one of the few chipmakers capable of making the kind of high-end graphics processing units (GPUs) needed to train and deploy generative AI models. AMD has a host of new AI chips to be released — MI300A and MI300X – that are “on track” for volume production in the current quarter. During the recent conference call, AMD’s CEO Lisa Su said, “We now expect datacenter GPU revenue to be approximately $400 million in the fourth quarter and exceed $2 billion in 2024 as revenue ramps throughout the year.”

AMD may become a formable competitor to market leader Nvidia.

During Marvell Technology’s (MRVL) recent 2Q24 results, the company announced that net revenue was $1.341 billion, $11 million above the mid-point of the company's guidance provided this past May. For the 3Q24, net revenue is expected to be $1.400 billion +/- 5%. That compares to an average analyst’s estimate of $1.398 billion. The Datacenter segment posted revenues of $459.8 million, +5.5% QoQ. Data Center revenue was driven by accelerating demand for 800G PAM-4 for AI deployments (for NVDA HGX/DGX and Google TPU clusters). 400G business is also faring well on AI-driven traffic growth in Cloud datacenters (overall Cloud revenue grew more than 20% QoQ). The Data Center segment should continue to drive demand for high-speed connectivity. Management now expects to exit the year at $200 million per quarter AI revenue run rate versus. a previously communicated $400 million run rate. This estimate reduction in the AI revenue run rate led to a sell-off in MRVL’s stock price. However, the fundamentals are still intact as MRVL’s 800G PAM4 DSP platform gives the company an offering in the lucrative AI chip space. Marvell remains the DSP market leader with competition from Broadcom, Credo and ASIC IP cores.

Nvidia continued to defy all odds with another blowout 3Q24. Along with guidance for a chart-topping 4Q24 revenue estimate of $20 billion +/- 2%. Nvidia reported 3Q24 Revenue of $18.12 billion versus an estimate of $16.18 billion, representing a whopping 206% YoY growth rate. Net income, at $9.24 billion, or $3.71 per share, was up from $680 million, or 27 cents per share, in the same quarter a year ago. The company’s data center unit (that houses the AI chip business) saw revenues total $14.51 billion, up 279% YoY. The gaming segment contributed $2.86 billion, up 81% YoY. During the quarter, Nvidia announced the new GH200 GPU, which has more memory than the current H100 (leading AI chip) and an additional Arm processor onboard.

How does the Competition Stack up for AI Chips?

| Company Name | AI Chip | Type |

| Nvidia | Hopper DGX H100 (*H800) | GPU |

| Nvidia | Grace Hopper GH200 | GPU |

| Nvidia | A100 (*A800) |

GPU |

| Nvidia | * H20, *L20, *L2 |

GPU |

| AMD | MI300X | GPU |

| AMD | MI300A |

GPU |

| Alphabet | TensorFlow TPU v4 | TPU |

| Broadcom | Jericho3-AI |

GPU |

| Intel | Falcon Shores |

GPU |

| Intel | Habana Gaudi3 |

TPU |

| Marvell Technology | 800G PAM4 DSP |

DSP |

| Qualcomm | Cloud AI 100 |

ASIC |

| GPU = Graphics Process Unit; CPU= Central Processor Unit; TPU = Tensor Processor Unit; DSP = Digital Signal Processor; ASIC = Application Specific Integrated Circuit; * = China Market version/configuration | ||

The PC Industry appears to be recovering. Both Intel and AMD continued to see their PC Computing segments show some incremental improvements in a challenging environment. Intel’s Client Computing segment posted 3Q23 revenues of $7.863 billion, down only 3.21% YoY, while AMD’s Client segment during the same period posted revenues of $1.453billion, an increase of 42% YoY.

Smartphones – According to IDC, the worldwide smartphone market will reach 1.15 billion units shipped in 2023, down 4.7% from the 1.20 billion units in 2022. From there, shipments will hit 1.31 billion units in 2027, the final year of the forecast period, resulting in a CAGR of 1.7%. Apple recently reported during its 4Q23 an iPhone revenue increase of 2.7% YoY. This quarter only considered a few weeks of sales for Apple’s new iPhone 15. Can iPhone lift smartphone sales into FY2024? AAPL appears to be on track with iPhone, iPad and MacBook builds. Recently, Bluefin research estimated that Q4 iPhone builds declined 2 million, to 79 million. For FY2023, total iPhone builds ended up at 223 million, which was down 5% YoY.

During Qualcomm’s recent 4Q23 results, the company topped both earning and sales estimates. For the upcoming 1Q24, Qualcomm said it expected adjusted earnings of between $2.25 and $2.45 per share in between $9.1 billion and $9.9 billion of sales in the current quarter, versus a consensus estimate of $2.23 per share of earnings on $9.2 billion of sales. The updated revenue expectation for the upcoming 1Q24 places the revenue mid-point at $9.5 billion, representing a 1% YoY gain.

Qualcomm is one of the top makers of the modem chipsets that go into Apple’s iPhones. Qualcomm is said to generate up to 20% of its revenue from Apple as a customer. During Qualcomm’s 4Q23 conference call management stated that, “We are seeing early signs of stabilization in demand for global 3G, 4G, 5G handsets.” Further, “Qualcomm expects total shipments using its handset chips to decline “mid-to-high single-digit percentage” in 2023 versus last year, which is better than the company had previously expected.

Another top smartphone chipmaker, Qorvo, made encouraging signs during its 4Q23 results. Qorvo makes radio-frequency chips used in 5G base stations, as well as for cellular and WiFi connectivity in smartphones and other gadgets is a major supplier to Apple, which contributed 37% to the company's total revenue in fiscal 2023. The company recently reported strong 4Q23 results, with quarterly revenue up 70% sequentially and exceeded the mid-point of revenue guidance by $103 million. The company also significantly reduced inventory while improving Android channel inventory.

Taiwan Semiconductor (TSMC), one of the world's largest semiconductor foundry for producing chips, showed strong October results; mostly N3 shipments for iPhone 15 Pro models channel replenishment, according to Bluefin Research. The October results are certainly encouraging, with a great majority of the upside from A17 processors that were staged for the iPhone 15 Pro model channel replenishment following the September launch.

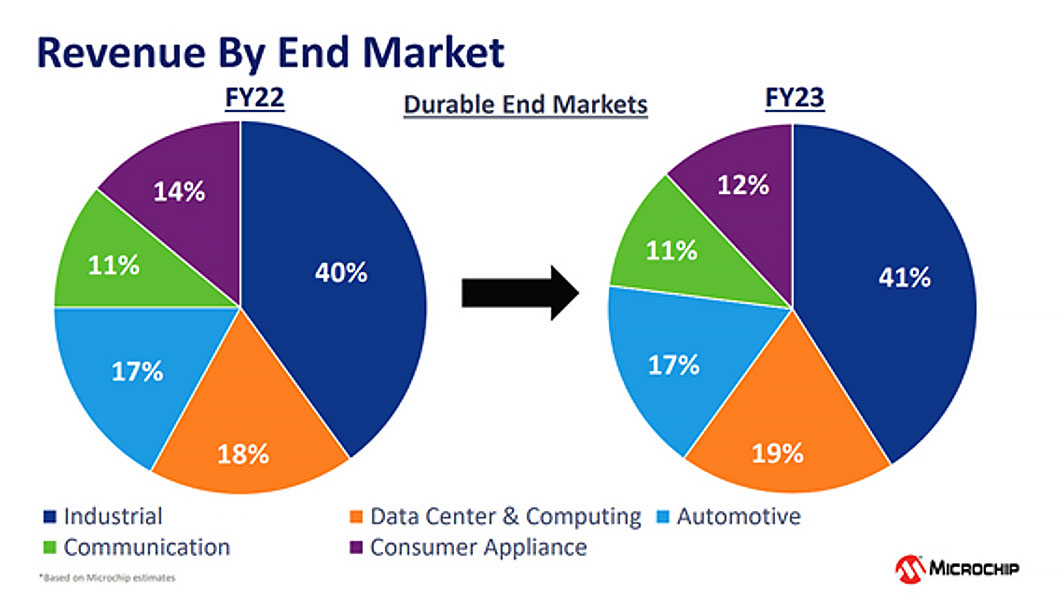

Automotive/Industrial — According to Mordor Intelligence the Automotive Semiconductor Market size is expected to grow from $71.62 billion in 2023 to $140.52 billion by 2028, at a CAGR of 14.43% during the forecast period (2023-2028).

Texas Instruments (TI) is a good gauge of the overall health of the Analog chip space, with 38% and 36% of revenues coming from the Industrial and Automotive industries. During TI’s recent 3Q23 results, revenue was flat sequentially and decreased 14% from the same quarter a year ago. Texas Instruments CEO Haviv Ilan said, “During the quarter, automotive growth continued, and industrial weakness broadened.” Further, TI management commented that the industrial market was down mid-single digits sequentially, with weakness broadening across nearly all sectors. For the upcoming fourth quarter, Texas Instruments said it expects revenue between $3.93 billion and $4.27 billion and earnings between $1.35 and $1.57 a share. Analysts were looking for revenue of $4.502 billion and adjusted earnings of $1.79 a share.

In line with TI’s results, NXP Semiconductors delivered 3Q23 revenue of $3.43 billion, $34 million above the mid-point of guidance. Revenue trends in Mobile, Industrial & IoT and Automotive end-markets all performed in-line or better than anticipated, while Communication Infrastructure & Other end market was slightly below expectations. The combination of third quarter results, and the mid-point of fourth quarter guidance indicates revenue for the full year 2023 will be flat versus 2022 in a challenging and cyclical market environment. During the recent 3Q23 report, NXP’s Automotive segment (representing 55% of sales) posted revenues of $1.891 billion, up 4.8% YoY, while the Industrial & IoT (representing 17% of sales) segment posted revenues of $607 million, or -14.8% YoY.

So, what can we conclude in regard to overall health of the semiconductor market? With the expansion of usage for chips beyond just PC/Laptops/Smartphones it appears that semiconductors have become less cyclical on average. Multiple end markets drove this, each having its own inventory cycles. On the net, it has smoothed out the results. This theory seems to be playing out here. While PCs and smartphones had a massive correction post the COVID work-from-home demand spike, Automotive and Industrial segments were buoyant. Since that time, PCs and Smartphones have made the biggest improvements this recent quarter, while Automotive and Industrial segments have weakened, showing clearly an overall market that is not as correlated to the more traditional segments like PCs and smartphones.

Looking forward in the smartphone space, expecting iPhone 15 to create another demand wave allowing iPhone volumes to reaccelerate again. For 2023, iPhone unit volume is now expected to fall to 223 million units for 2023 (+5.0%), but rebound to 230 million in 2024 (+1.8%). This consensus estimates of 230 million iPhones for 2024 maybe a bit light!

All the datacenter chip makers – INTC, AMD, MRVL and NVDA – posted QoQ revenue gains in their respective Data Center units. Cloud customers are rapidly shifting budgets toward AI, so this strength is coming at the expense of traditional Sapphire Rapids and Genoa platforms and other legacy areas. This trend will most benefit the chipmakers with the strongest AI offerings, like NVDA.

Overall, it appears that the semiconductor industry has been in a secular rebound since February of 2023 and is on the track to fully recover by mid-2024!

Important Disclosure Information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.