Learn

How to Approach Withdrawals from Your Portfolio At Retirement

By Jarrett E. Hindrew, CFP®, ChFC®

One of the biggest concerns for retirees is how much they can safely withdrawal from their portfolio without spending down their assets. This phase is more challenging for advisors and investors to manage because while they are withdrawing funds from their portfolio, they are also having to manage risk such as market volatility, inflation, taxes, health cost and longevity.

Last week, a nationally syndicated radio show host who offers personal financial advice recommended that retirees invest 100% of their portfolio assets in equities and withdraw 8% from their portfolio per year to provide for retirement income. The advice was as follows:

“If you’re making 12 [percent] in good mutual funds and the S&P [500] is averaging 11.8, and if inflation for the last 80 years is 4%, if you make 12 and you need to leave 4% in there for average inflation raises, that leaves you eight. So, I’m perfectly comfortable drawing eight. But if you want to be a little bit conservative, seven. But, sure, not five or three.”

There is a lot to unpack in that advice. First, ignoring the recommendation that a retiree should maintain a portfolio consisting of 100% equities (a discussion for another day), the math presented of earning 12% per year, leaving 4% for inflation, and withdrawing 8%, seems fairly straight forward when taken at face value. However, not only is the math not correct1 but this advice fails to consider how market volatility and the sequence of returns impacts the sustainability of one's savings over an extended period.

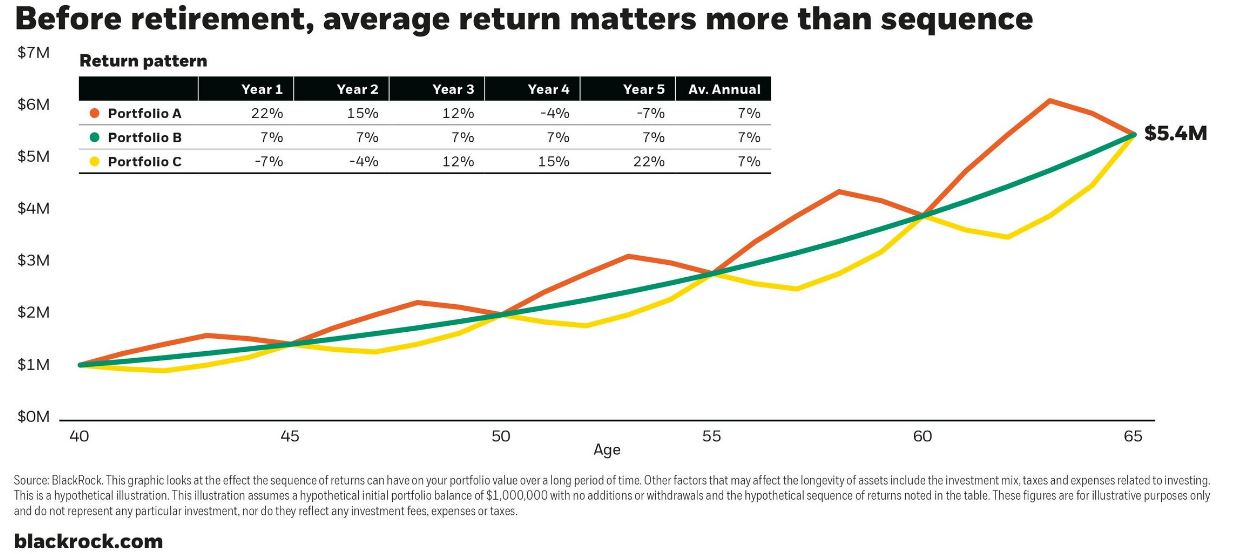

During one’s working years, while saving and accumulating assets, the order of your gains and losses (Sequence of Returns), has little impact on your portfolio. The examples below illustrate three hypothetical portfolios that all averaged a 7% rate of return, but experienced different paths to get to the same value.

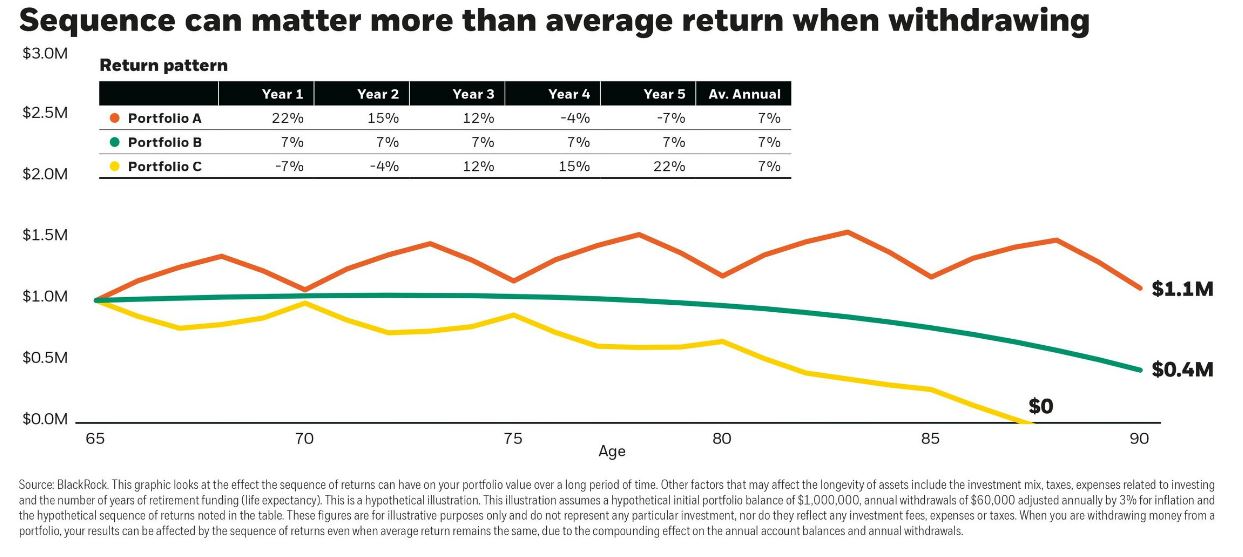

Sequence of Return Risk (SORR) occurs when a retiree experiences poor investment performance during the early years of retirement. The impact of SORR is magnified when retirees start drawing from the portfolio, as withdrawals coupled with negative returns can quickly erode savings. Conversely, favorable investment returns in the initial years can enhance a portfolio's longevity. As the sequence of returns cannot be predicted with certainty, it is vital for retirees to assess the potential risks and develop strategies to mitigate them. The example below illustrates the same three portfolios with a 7% average return, but are now taking $60,000 per year, adjusted for inflation in annual withdrawals.

A traditional approach to withdrawing from a retirement portfolio involves maintaining a constant withdrawal rate based on a fixed percentage (e.g., 4%) of the initial portfolio value. However, this strategy does not account for the potential effects of SORR. To counteract this risk, the concept of dynamic withdrawal rate has gained prominence.

Dynamic withdrawal rate strategies adjust the withdrawal rate annually, considering the portfolio's performance relative to expected returns and remaining life expectancy. By incorporating the actual portfolio performance into annual withdrawal decisions, dynamic withdrawal rate strategies aim to better manage SORR.

Benefits of Dynamic Withdrawal Rate:

1. Flexibility: Dynamic withdrawal rate strategies offer flexibility by enabling retirees to adjust their withdrawals in response to market conditions. It builds on a natural tendency to spend more when portfolio values are up and less when values are lower.

2. Preservation of Portfolio: By adopting a dynamic withdrawal rate strategy, retirees can better preserve their portfolio's longevity. By reducing withdrawals during unfavorable market conditions, retirees can enable the portfolio to recover and potentially benefit from future market upturns.

3. Peace of Mind: Dynamic withdrawal rate strategies can provide retirees with peace of mind, knowing that their withdrawal decisions are based on actual portfolio performance and varying market conditions. This approach reduces the potential for outliving savings and increases confidence in the sustainability of the retirement plan.

Planning for retirement and implementing a dynamic withdrawal rate strategy requires careful consideration of various factors. Some challenges include determining an appropriate withdrawal rate formula, estimating remaining life expectancy and managing the psychological impact of fluctuating withdrawal amounts. Working with a financial advisor, considering historical market data, and periodically reassessing the strategy can help retirees navigate these challenges effectively.

Important disclosure information

This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. We do not make any warranties as to accuracy or completeness of this information, do not endorse any third-party companies, products, or services described here, and take no liability for your use of this information. Diversification does not ensure against loss.

- Between 1926-2022, the S & P 500 has earned a 12% average rate of return per year using the arithmetic mean. This calculation fails to consider the effect of compounding. The geometric mean, which is sometimes referred to as compounded annual growth rate or time-weighted rate of return, during the same time period is approximately 10%. Geometric mean should be used to calculate portfolio investment returns. Back